Investors have been intently focused on the outcome of the G20 Summit in Buenos Aires on Dec. 1 — specifically the announcement that a 90-day deadline has been agreed to try and achieve a deal between America and China. As a result, the implementation of the next round of tariff increases from Jan. 1 has been postponed.

Tariffs on US$200 billion of imports from China were scheduled to increase from the current 10% to 25%. Donald Trump had also threatened to impose 10-25% tariffs on the remaining US$267 billion of imports from China if a deal was not agreed on Dec. 1.

This seeming truce is important because if that tariff increase had gone ahead the risk rises of more aggressive retaliation from the Chinese side. For example, Beijing could send the signal to Chinese consumers to stop buying American goods, just as it did in the case of South Korean goods when the THAAD missile defence system was installed in South Korea in March 2017.

Clearly, such retaliation leads to a negative dynamic that ultimately benefits no one. But equally clearly, Beijing cannot for face reasons sit by and take no retaliatory action if the Trump administration follows through on its various threats.

News of this truce was positive for markets, particularly Asian stock markets, at least until the news surfaced on Wednesday on the arrest by Canadian police of Huawei’s chief financial officer Meng Wanzhou in Vancouver at the request of the U.S. The guess here at this point is that this episode concerning China’s highly successful telecommunication equipment company is more of a cock up than deliberate sabotage. This is because it is assumed that Donald Trump wants to do a deal, in this case taking a profit on his 'beating up China' strategy.

None of the above means that there will not be continuing friction between China and America on a whole host of issues. But if the threatened tariff increases had been imposed, it will then have become much harder for 'face reasons' for Beijing to make concessions without looking like it is succumbing to Washington bullying. The pressure will also then be on Beijing to adopt more aggressive stimulus to counter the negative impact from the trade war. But the central government would prefer not to engage in heavy-handed stimulus, given its three-year long squeeze on shadow banking.

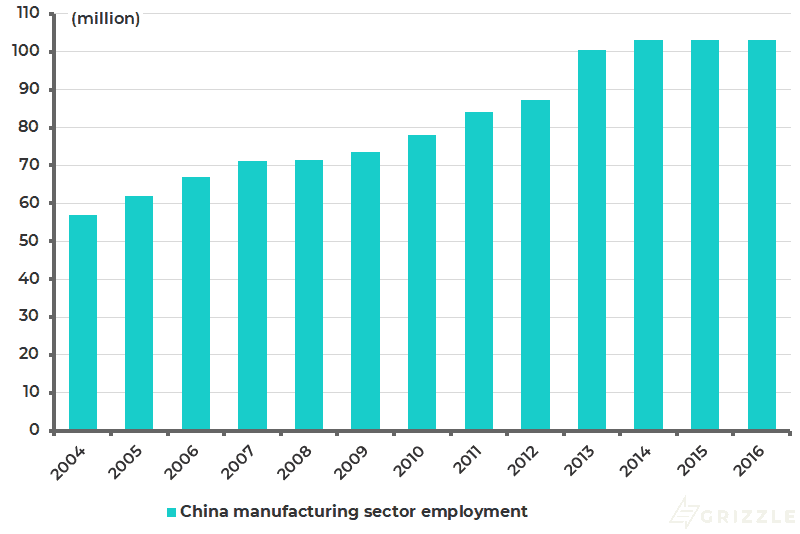

The view here remains that collateral damage from the squeeze on shadow banking, or so-called 'deleveraging', has been more responsible for the slowdown in the China economy this year and the related pain in the Chinese stock market than the trade war. It is also clear that the risk of economic fallout from rising tariffs is now growing. An estimated 103 million people are employed in China’s manufacturing sector (see following chart).

China total manufacturing sector employment

Note: Including urban and rural employment. Source: National Bureau of Statistics of China

It is also the case that, regardless of the trade issue, the focus of China’s deleveraging policy next year will switch from curbing shadow banking, where much of the work has now been done, to redirecting credit flows from so-called local government financing vehicles (LGFVs), SOEs, and households to private firms.

This certainly makes sense. But history suggests that getting banks to lend to the private sector in China is easier said than done. Still, it is clear that Beijing now realizes that more needs to be done to restore the confidence of the private sector which has lost previous sources of funding from the squeeze on shadow banking. This can be seen in the continuing collapse in bank lending to non-bank financial institutions. China depository corporations’ claims on other financial institutions declined by 7.1%YoY to a two-year low of Rmb26.4 trillion at the end of October and are now down 11.2% from the peak reached in January 2018 (see following chart).

China depository corporations’ claims on other financial institutions

Source: PBOC, CEIC Data

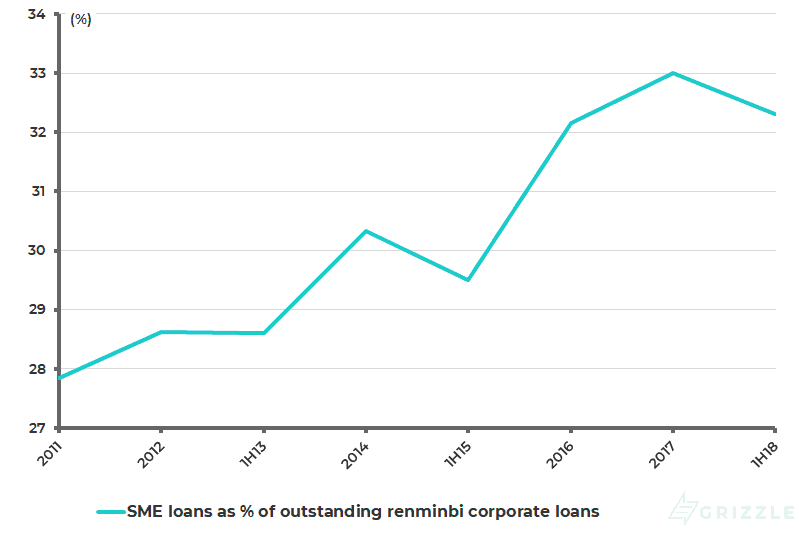

The most significant signal seen so far on this point of lending more to the private sector was a statement last month by Guo Shuqing, head of China Banking and Insurance Regulatory Commission (CBIRC) and the man who has been leading the whole deleveraging drive. He stated last month that regulators planned to introduce a policy whereby one-third and two-thirds of new corporate lending made by large banks and small banks, respectively, must go to private firms and that the ultimate goal is to allocate 50% of new corporate lending to private firms in three years. SMEs (mostly privately owned) accounted for 32.3% of outstanding renminbi corporate loans as at the end of 1H18 (see following chart).

China SME loans as % outstanding renminbi corporate loans

Source: CEIC Data, PBOC

These are ambitious targets and, from the standpoint of investors in bank stocks, have raised fears that Chinese banks will be forced to meet quota for lending to private sector firms. But while there are certainly grounds for skepticism on how such a policy is implemented, even if it is not by official quota, it does at least show that Beijing understands that the issue of reviving private sector confidence has now become a priority.

China certainly cannot afford to alienate the private sector, which is responsible for more than 50% of tax revenue, over 60% of GDP, over 70% of tech innovation, over 80% of urban employment and over 90% of the number of enterprises, according to official estimates. It should be noted that these so-called “5-6-7-8-9 contributions” are often cited by mainland officials and media, though there is never any hard data to confirm such statistics. But this again is a signal that China’s government understands the importance of the private sector.

Read the full article