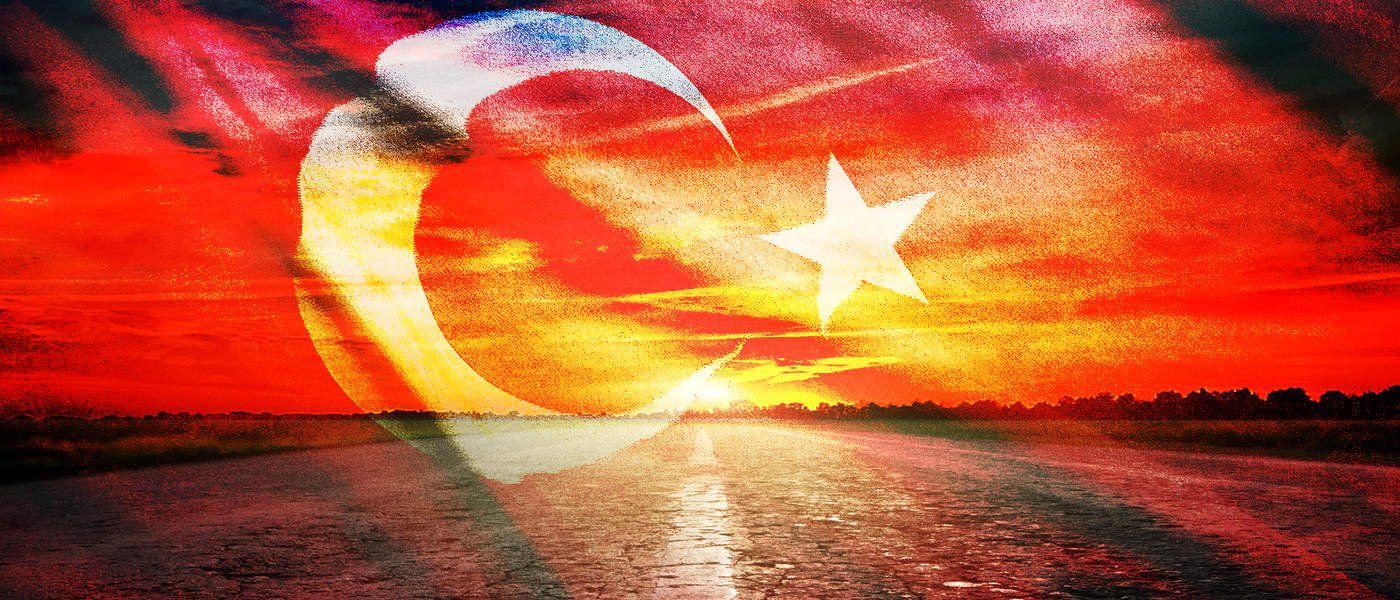

The US dollar index has recently broken above the 95 'resistance level'. The index rose to 96.98 on August 15 in a dollar rally triggered by the recent collapse of the Turkish currency and is now 95.15 (see following chart).

US Dollar Strength to Continue With Fiscal Easing and Monetary Tightening

The advice for now is to assume ongoing US dollar strength so long as there continues to be the 'macro combo' in a Donald Trump-led America, namely the combination of fiscal easing and monetary tightening. For such a combination led to peak US dollar strength in the first few years of Ronald Reagan’s presidency.

US Dollar Index

Source: Bloomberg

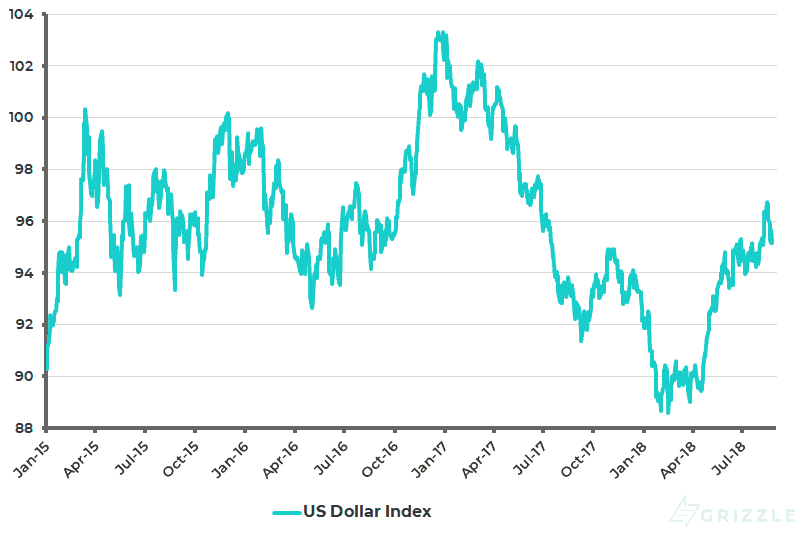

This means that the key point is whether this macro combination is maintained. Continuing fiscal easing would seem almost inevitable under Trump and certainly projected fiscal deficits are rising. The Office of Management and Budget (OMB) last month revised up estimated budget deficits by about US$100 billion, compared with the February budget forecasts, for the next five fiscal years beginning October 1.

The Trump administration now expects the fiscal deficit to exceed US$1 trillion for each of the next three fiscal years (see following chart). The collapse in corporate tax revenues courtesy of tax reform can also be seen in the latest data. Corporate tax revenues declined by 52% YoY in July and were down 39% YoY in the past six months (see following chart).

Trump Administration’s Budget Deficit Forecast Revisions

Source: Office of Management and Budget (OMB)

US Annualized Corporate Tax Revenues

Source: US Treasury, CEIC Data

Continued Rate Hikes and Balance Sheet Contraction

That leaves the other issue of whether monetary tightening continues in America. And, remember, Fed tightening comprises both interest rate hikes and balance sheet contraction. This is why it remains a critical point whether US cyclical momentum peaked last quarter.

That is the base case here but it is going to take weakening data to change current investor expectations of monetary tightening, most particularly as money markets are already discounting fewer rate hikes through to the end of 2019 than the so-called 'dot plots' comprising Fed governors’ individual interest rate forecasts. The money markets are now discounting 75bp of rate hikes through to the end of 2019, while the Fed’s 'dot plots' are forecasting 125bp over the same period.

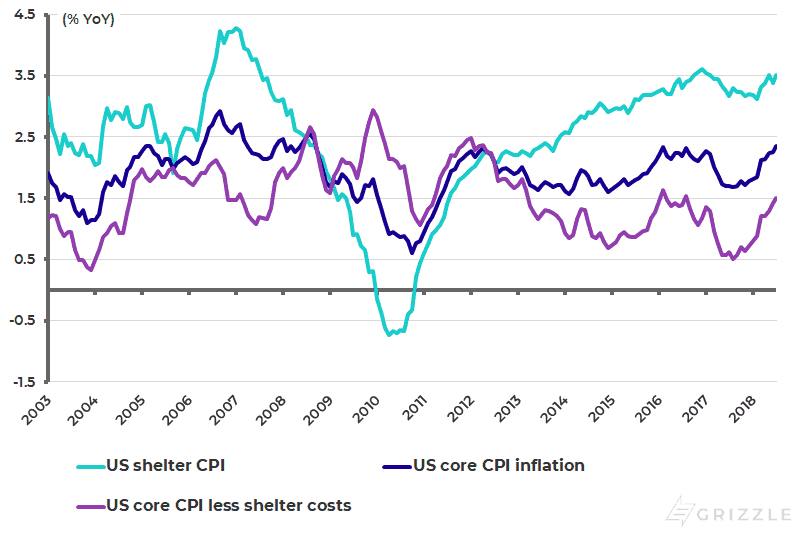

For now, it seems evident that the next meeting on September 25-26 will see another rate hike. On this point, core CPI inflation rose from 2.3% YoY in June to 2.4% YoY in July, the highest level since September 2008 (see following chart). Meanwhile, the more the Fed tightens from here, the more likely it becomes that Donald Trump will inject himself more actively into the debate about monetary policy in terms of criticizing Fed policy. It will be interesting to see how the Fed leadership and the dollar react in such circumstances.

US Core CPI Inflation

Source: CLSA, US Bureau of Labour Statistics

Turkish Lira on the Rebound

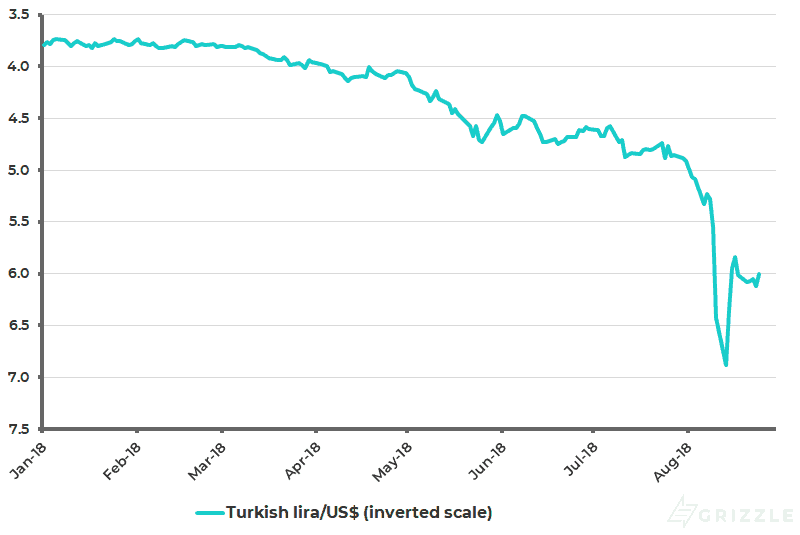

The Fed will raise rates next month despite the latest fallout in Turkey and related spillover into other emerging markets. The Turkish lira depreciated by 23% against the US dollar in the three days ended August 13, though it has since rebounded by 15% (see following chart).

Turkish lira/US$ (inverted scale)

Source: Bloomberg

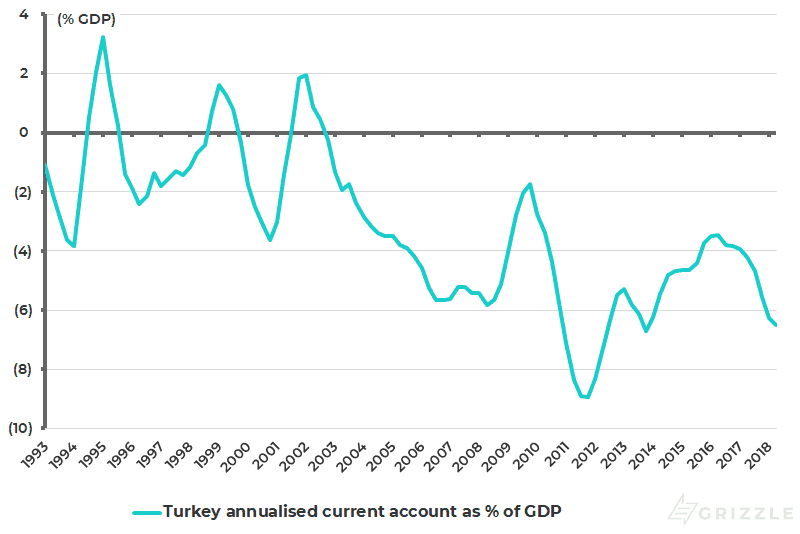

Fed chairman Jerome Powell has made it clear in speeches that he believes emerging markets are better positioned to handle monetary tightening than in the past. It has certainly been the case that, in the emerging market debt context, Turkey has long been viewed as a prime candidate for triggering such a crisis. The reasons are high dollar borrowing and a habit of running large current account deficits. Turkey’s current account deficit has averaged 5.2% of GDP over the past 12 years (see following chart).

Turkey Current Account as % of GDP

Source: CEIC Data, Central Bank of the Republic of Turkey

Which Route Will Turkey Take?

But the view here is that the key driver of Turkey’s problems of late are political, not economic. This is because Turkey, under the recently re-elected President Recep Tayyip Erdogan, is no longer in the Western camp, as was made very clear by Trump’s provocative tweet on August 10 when, in the midst of the lira’s collapse, he stated that he had authorized a doubling of tariffs on steel and aluminium imports from Turkey to 50% and 20%, respectively.

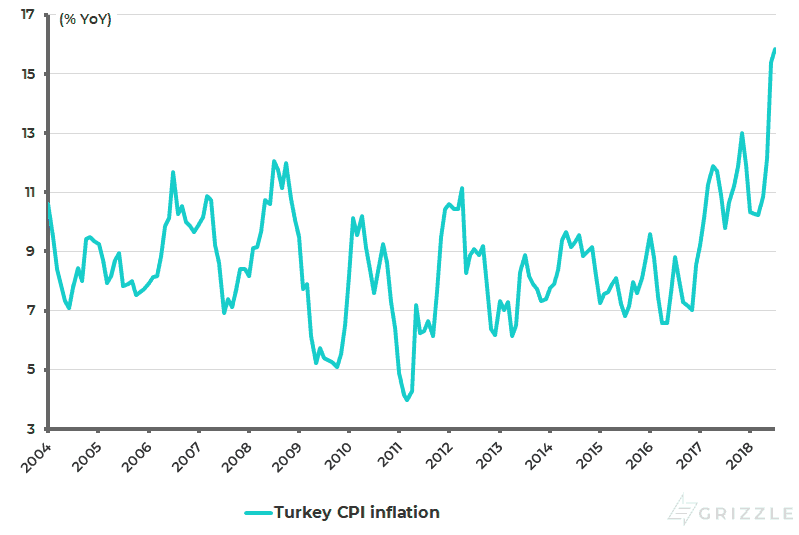

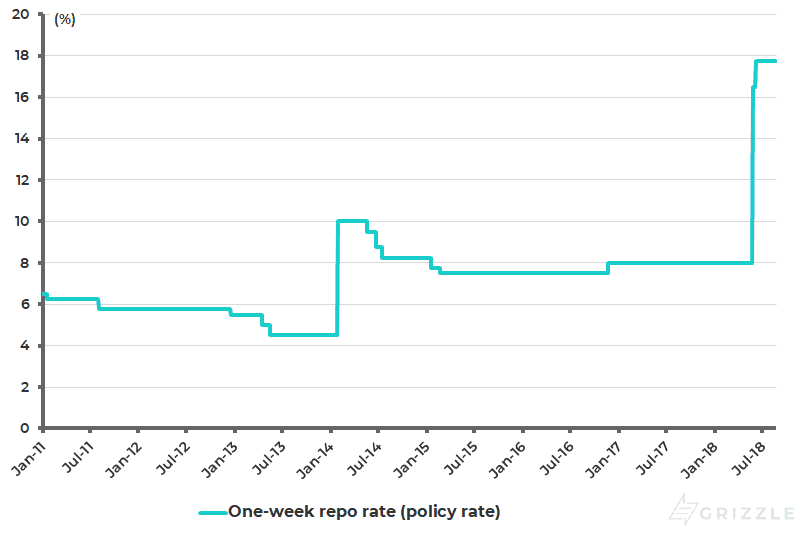

The choice facing Erdogan is now clear. He can play the orthodox game and raise interest rates aggressively and appoint a new finance minister who is not his son-in-law. Inflation is currently running at 15.8% YoY (see following chart) while the central bank’s policy one-week repo rate is 17.75%, with the central bank having not raised rates since early June (see following chart).

Or he can follow the precedent set by Mahathir Mohamad in Malaysia in 1998 and close the capital account with a view, in Turkey’s case, of obtaining emergency funding from the likes of Russia and China and friends in the Middle East, such as Qatar, which pledged on August 15 to invest US$15 billion in Turkey.

Turkey CPI inflation

Source: CEIC Data

Central Bank of Turkey Policy Rate (One-week Repo Rate)

Source: Bloomberg

While perhaps still not the base case, the possibility of such a development, in terms of the closure of the capital account or some other form of constraint on convertibility, has grown significantly over the past week given the scale of the Turkish currency’s collapse and the unhelpful reaction from Washington in terms of the threat of Turkey targeted sanctions.

Furthermore, in a Trump-led America any mooted IMF bailout of Turkey is likely to have its conditions dictated by America, as the IMF’s largest shareholder. That would not likely be acceptable to Erdogan.

Read the full article