As news that Northern Trust Corporation is preparing to create a crypto custody solution was reported by Bloomberg yesterday, the stage is being set for a battle over who high net-worth individuals and institutions will trust to store their crypto.

Will the custodians of traditional assets leverage their name brand and established relationships or will crypto exchanges use their experience of dealing with the technology behind crypto assets to profit from the lucrative business of storing and securing high value crypto portfolios?

Wait, Is Northern Trust Developing Crypto Custody Solutions or Providing Administrative Services to Crypto Curious Hedge Funds?

Northern Trust, the nearly 130 year old financial services firm that caters to corporations, institutional investors, and high net worth individuals has $10.7 trillion in assets under custody/administration according to their website.

While the previously referenced article from Bloomberg indicates that Northern Trust is developing a crypto custody solution for its customers, a separate article from Forbes also published yesterday tells a slightly different story.

The more in-depth Forbes article references an 'exclusive' interview with Northern Trust's president, Pete Cherecwich, indicating that the firm isn't directly developing crypto custody solutions for customers but rather has more to do with working with three 'mainstream hedge funds' who are diversifying into crypto assets.

The article indicates that Northern Trust has been acting in an administrative capacity for these hedge funds to assist with reporting and fund administration with respect to those firms' cryptocurrency positions.

While the Forbes article paints a picture of Northern Trust working on multiple projects related to cryptocurrency and blockchain integration into their other services, the Bloomberg article states the firm is developing its own custody solution and quotes an interview with Cherecwich inferring that conclusion:

Either way, the firm is continuing to pour resources into the burgeoning institutional investment side of crypto and following the lead of Fidelity and others into this new market. The Forbes article also contains a quote from Cherecwich that highlights the opportunity and work to be done in crypto assets:

Who will the Institutions Trust to Hold their Crypto Bags?

One of the unique aspects of cryptocurrencies as an asset class is that there are tools available to everyone to be able to hold and secure their investments. In fact, part of the appeal of crypto is that it can be personally controlled and held without the need for trusting a third party custodian like a bank.

For personal investors, there are simple solutions to keep your crypto safe and secure through using a crypto wallet. Also, most crypto exchanges already allow their users to store their crypto on the exchange itself, although this is generally not recommended due to the risk of exchanges being hacked.

These solutions are sufficient for personal investments where a single person can control and is responsible, but institutions have a different set of needs and risk tolerance. Institutional investors are accustomed to using custodial solutions and companies to safeguard their assets. Their fiduciary responsibilities necessitate reducing the risk on their investments as much as possible and the added technical complications of allowing multiple people different levels of access to the crypto assets become complicated using the consumer solutions.

In addition, given the large size of investment some firms would likely be making into crypto assets the level of security surrounding the access to those assets needs to be further re-enforced. While the blockchain is secure, there are vulnerabilities around the storing and securing of the private keys that allow access to the investments.

Many of the new players in the crypto ecosystem recognize these needs of institutions and have been developing their own crypto custody solutions. One of the largest crypto exchanges in the US, Coinbase, for example recently launched their Coinbase Custody service directly targeting large financial institutions. Others, such as Gemini have operated sophisticated custody solutions targeted at institutions for some time.

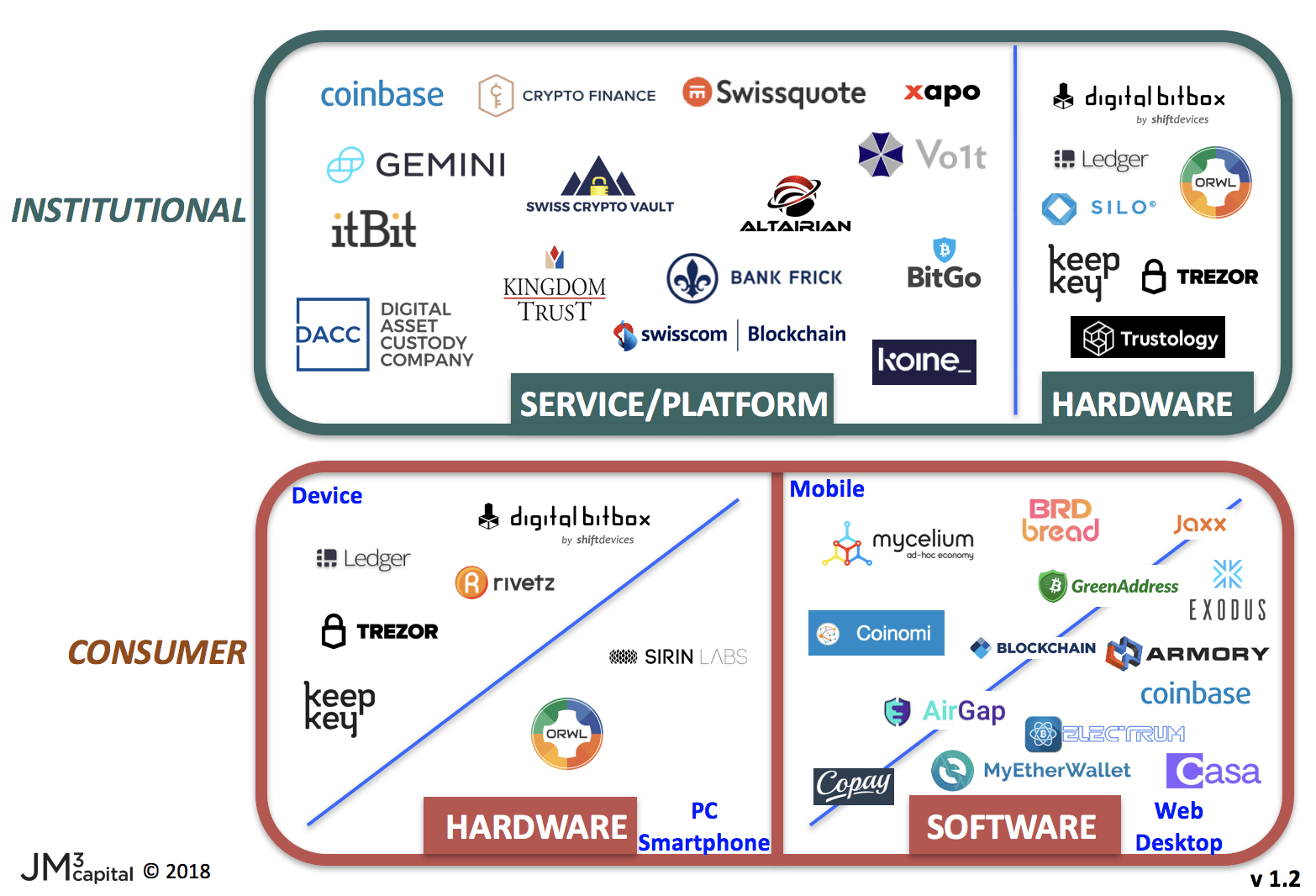

A Good Overview of Existing Crypto Custody Solutions

Source: Jean-Philippe Jabre on Medium

These crypto custody solutions from established players in the crypto ecosystem do typically come with the high fees that Cherecwich referred to which leaves room for competition.

Given the established trusted relationships that many traditional financial services firms who offer custodial solutions for their clients already have it seems likely that someone from that cohort is liable to make a splash into crypto eventually.

Stay Tuned for more Partnerships and M&A between the Old Guard and the New Guard

The most likely outcome in the crypto custody space is that the two sides find the win-win solutions to combine the crypto experience of the exchanges with the trust and contacts of traditional financial services firms.

We expect that as the market for crypto assets continues to mature, there will be a steady rise in partnerships, mergers and acquisitions among the players. As this begins to occur it will only embolden more and more institutional investors to seek out the opportunities that exist to profit from the emerging crypto asset class.

This potential is the ideal scenario for all involved as traditional financial services firms expand into the new asset class, crypto firms develop new institutional customers and investors take advantage of the additional liquidity. Talk about a win-win-win!

Read the full article