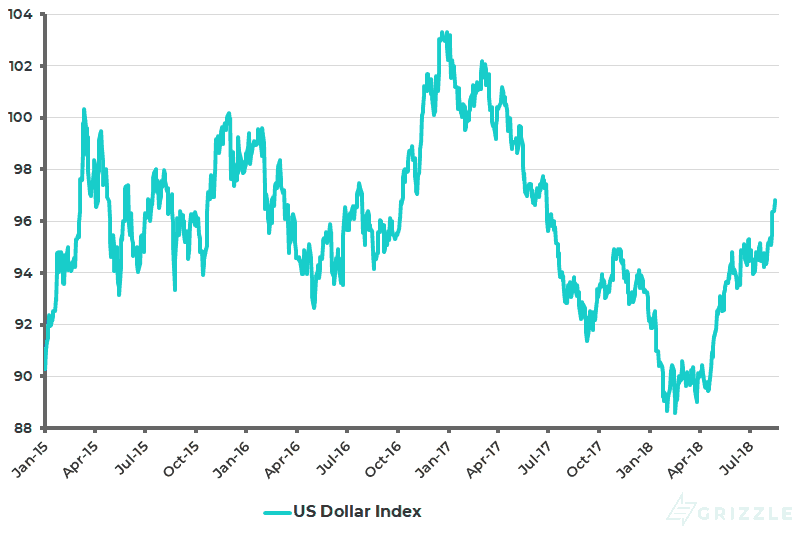

The immediate focus of markets of late has been the resurgent US dollar (see following chart) amid the collapse of the Turkish currency, down 23% against the US dollar in the three days ended August 13, which has also caused other emerging market currencies to weaken.

Trade War Pleases US Dollar Bulls

But there also remains the 'trade war' issue, where the evidence so far suggests that escalating concerns about trade conflicts are US dollar bullish. This is on the simple view that other countries will be hurt more than America by such a trade war.

US Dollar Index

Source: Bloomberg

The past few weeks has seen a revival of such trade concerns with Donald Trump’s decision on August 1 to consider increasing the threatened tariff rate on another US$200 billion of Chinese goods to 25% from 10% and China’s response on August 3 when it threatened retaliatory tariffs of 5-25% on US$60 billion of US imports.

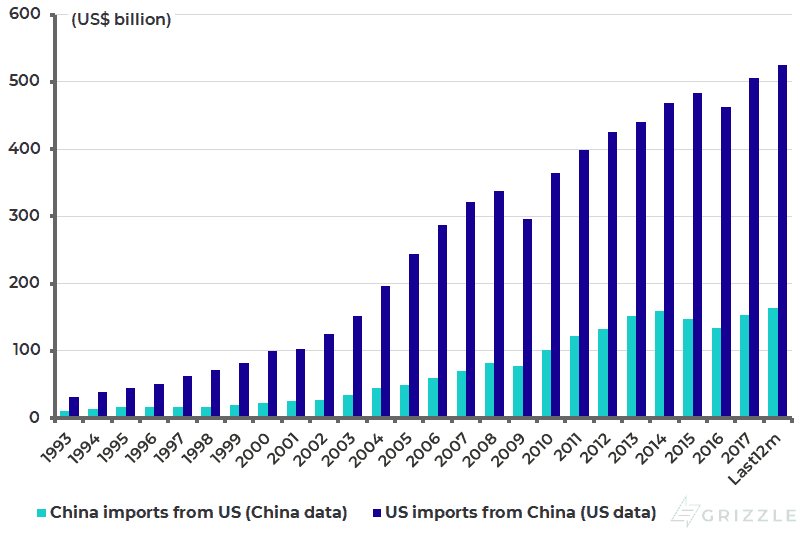

China’s problem here remains that there is a limit to the policy of 'tit for tat' retaliation it can indulge in for the simple reason that America buys more goods from it than it buys from America.

US imports from China totalled US$525 billion in the 12 months to June 2018, while China imported US$163 billion of goods from America over the same period (see following chart). Hence, Beijing seems to be engaging in a policy of so-called proportional retaliation.

China Imports from US and US Imports from China (Goods)

Note: Data up to the 12 months ended June 2018. Source: US Census Bureau, China General Administration of Customs, CEIC Data

What Beijing will clearly be hoping for is that the Donald backs off on trade and declares a victory ahead of the November mid-term elections on the view that the negative political consequence of tariffs, namely higher prices for American consumers, may by then have become more of an issue for voters.

What is the likelihood of such an about face, which would require Trump to ignore the counsel of his trade warriors such as National Trade Council Director Peter Navarro and Trade Representative Robert Lighthizer? It is certainly a distinct possibility since the modus operandi of the Donald appears to be to adopt extreme negotiation positions and then do a deal on much softer terms after declaring a 'win'.

Is Trump's 'Deal' with Europe for Real?

Those in Beijing and elsewhere hoping for such a deal will have drawn comfort from Trump’s agreement late last month with European Commission President Jean-Claude Juncker, since it is very unlikely that Navarro or Lighthizer would have approved such a deal.

Trump and Juncker agreed on July 25 that they will work together toward zero tariffs, zero trade barriers and zero subsidies on non-auto industrial goods. The EU also agreed to start buying a lot more US soybeans and to import more liquefied natural gas (LNG) from America, though there was a complete lack of specific details.

It is also unclear that Juncker has the authority to enforce such an agreement. For example, does the European Commission have a budget to purchase soybeans or LNG? Or, for that matter, does it have the power to direct private firms to buy imports from a particular jurisdiction? It would seem extremely doubtful.

This is why the answer to what is going to happen on trade lies in Trump’s head which makes it, by definition, hard to predict. Still, the risk of a further escalation in confrontation is real, if far from inevitable, for the simple reason that Trump has always had a hawkish view on the China trade issue and China is viewed as an economic rival to America whereas Europe is not.

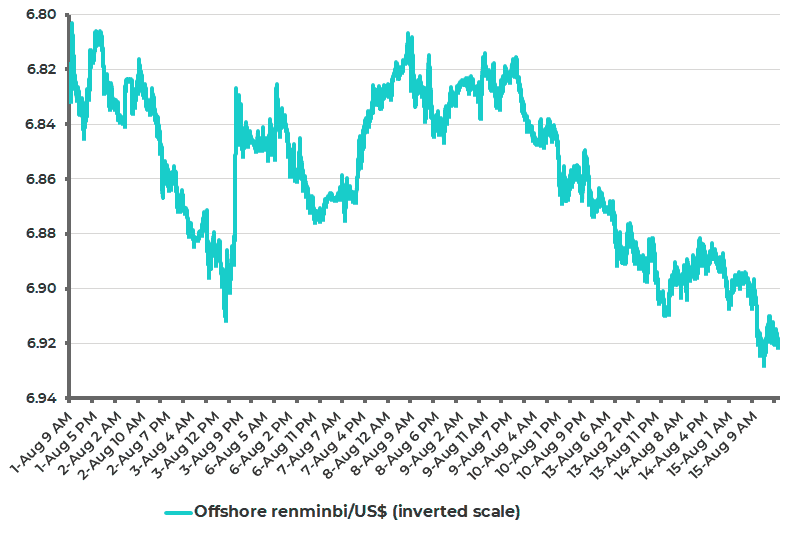

Putting Pressure on the Renminbi

Certainly, Beijing cannot afford to assume that a negotiated solution will occur on the trade issue; though it is also clear that Treasury Secretary Steven Mnuchin, who is not a trade warrior, would be able to negotiate a deal with China’s economic tsar Vice Premier Liu He very easily if he is allowed to by Trump. Meanwhile China has to take precautionary measures. And if an escalating trade war is likely to be dollar bullish that would mean more pressure on the renminbi.

This is the context in which the PBOC announced 20% reserve requirements on August 3 on the trading of some foreign exchange forward contracts, a policy which has had the practical effect of making 'shorting' the renminbi more costly. This is evidence that China is not following a policy of deliberate devaluation in response to the trade threat, as some have argued.

Intraday Offshore Renminbi/US$ (Inverted Scale)

Source: Bloomberg

The reason China is not comfortable is concern about capital flight following what happened in late 2015 and early 2016 when the renminbi came under pressure. This is another reason, beyond the threat to its export sector, why China does not want a trade war.

But that does not mean that the renminbi will not be allowed to depreciate further if it is in line with broader market forces, say another Italian politics-driven decline in the euro causing a generalized dollar rally or more Turkey-related turmoil leading to weakening for emerging market currencies in general. But the view here is that the renminbi will not be allowed to depreciate significantly from current levels in the absence of such broader market developments.

Meanwhile, what is clear in China is that the more than two-year-long deleveraging campaign, and related attack on shadow banking, has finally started to impact the mainland economy in a more meaningful manner. This, and the threat to the export sector posed by Trump’s policies, explains the acceleration in easing measures of late. Examples of such easing measures in Beijing are a boost to infrastructure spending and providing incentives to banks to lend more to SMEs.

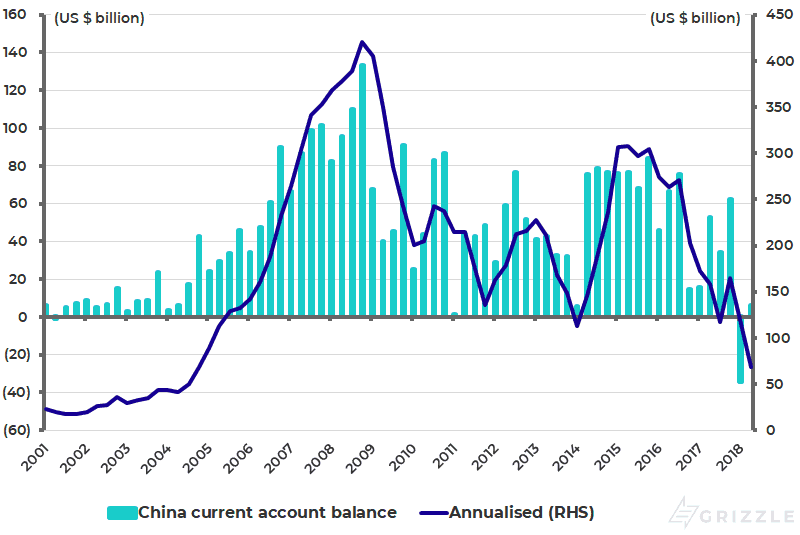

These policies should be seen as fine tuning and not a U-turn into renewed stimulus. Meanwhile, it is worth noting that China’s ability to manage its currency going forward will be made more difficult by the now clearly established trend of a shrinking current account surplus. On an annualized basis, China’s current account surplus has declined from US$304 billion in 2015 to US$68 billion in the 12 months to June 2018 (see following chart).

China Current Account Balance

Source: CEIC Data, SAFE

Read the full article