Yet another Bitcoin ETF delay is coming from the U.S. Securities and Exchange Commission (SEC). Yesterday, a decision from the regulator on a Bitcoin ETF proposal from Van Eck Securities and Solidx was postponed until September and crypto markets are not happy about it with most cryptocurrencies down about 10-20% over the last 24 hours.

This particular Bitcoin ETF delay surrounds a rules change request to list and trade shares of the Van Eck SolidX Bitcoin Trust on the Cboe BZX exchange. The SEC, which originally rejected the proposal in March 2017 is now considering the rebuttal from Van Eck, SolidX and Cboe BZX which outlined "significant changes in product, market structure and overall circumstances" based on a presentation to SEC Staff from July 2018.

The delay is a simple procedural delay to allow the SEC an additional 45 days to evaluate the proposal as they have received over 1300 public comments regarding the proposal which need to be reviewed as well.

The date mentioned in the SEC statement by which they will approve, disapprove or institute further proceedings regarding the proposal is September 30, 2018. However, it should be noted that if further proceedings are required a final deadline on a decision wouldn't be until 27 February, 2019, 240 days after the initial filing.

These latest developments in the ongoing battle between the SEC and securities products related to Bitcoin follows a little over a week after the regulator rejected a proposal to list and trade the Winklevoss Bitcoin Trust. Although, one SEC commissioner voiced her dissent regarding the rejection, the SEC still needs convincing.

Differentiators of Van Eck/SolidX Bitcoin ETF

Based on the presentation, Van Eck and SolidX are arguing that there have been several important changes in the market and product since the oriignal rejection.

One argument is that the market publicly traded vehicles has developed including the CME and Cboe Bitcoin futures markets which are regulated by the U.S. Commodity Futures Trading Commision (CFTC). The development of additional oversight from the CFTC and information sharing amongst over the counter (OTC) markets is another important change in the market structure since the rejection according to the presentation.

But perhaps the biggest change mentioned is that the Bitcoin ETF would now be targeted exclusively at 'non-retail' investors by listing its share price over $200,000. This is to address a concern from the SEC in its disapproval notice from March 2017 regarding the retail investors understanding the risks of investing in a Bitcoin ETF. Although this share price wouldn't necessarily prohibit retail investors from investing it would strongly discourage the behaviour.

Bitcoin ETF Delay Impacts on the Crypto Market

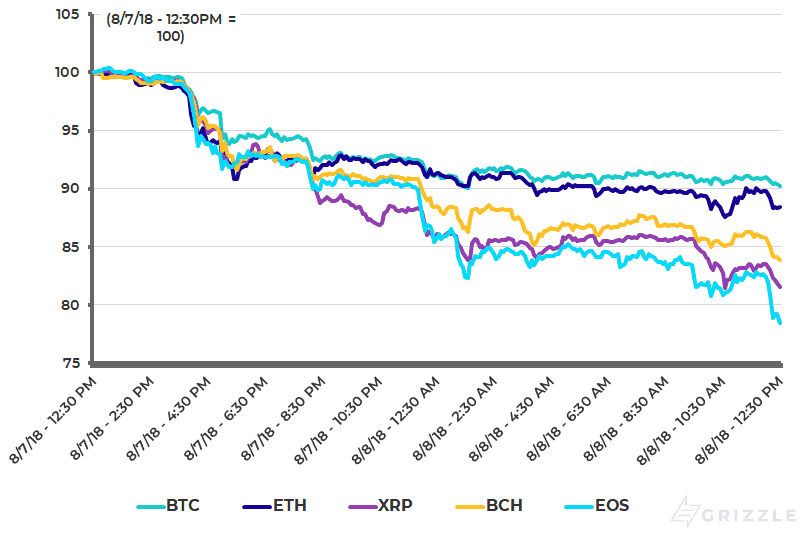

The news of the rejection which started hitting popular crypto news websites mid-afternoon yesterday didn't take long to drive a large sell-off in the crypto markets.

The Bitcoin ETF delay also didn't only affect the price of Bitcoin as all of the top coins have seen a significant price drop ranging from 10-20% over the past 24 hours.

Top 5 Coins Price Performance Over the Past 24 Hours

Data Source: www.cryptocompare.com

The precipitous drop in crypto prices may also be forcing some weak hands out of the market.

https://twitter.com/cryptomanran/status/1027081923376689152

Given, the impacts the Bitcoin ETF delay has had on markets, investors should keep an eye on future ETF related events. The following Reddit comment identifies some key dates for both the Van Eck/SolidX proposal as well as another ETF proposal in front of the SEC from ProShares.

Comment from discussion Definitive ETF-calendar, please..

Read the full article