Cannabis isn't even legal in Canada yet and already growers are rushing to find the next big consumer market.

The rush to expand and acquire customers has reached a fever pitch in the last 6 months as companies like Canopy Growth, Aurora Cannabis, Tilray, Aphria and many others sign what seems like a new letter of intent, supply deal or international asset purchase every week.

Even though the deals are spread all over the world, the industry has its eyes squarely on Germany as the next engine of profitability and growth.

Though the German legal cannabis market holds promise, when we look under the surface it exposes a market that is very likely to disappoint Canadian producers and cannabis investors over the next few years.

German Legal Cannabis - The Promise

Germany is where the industry sees the most near term growth in customers and profit potential for a number of reasons.

Large Population

Germany is big, full stop.

With a population of 84 million people, more than twice the size of Canada, Germany presents an enticing new market for licensed growers to gain a foothold and convert new medical patients and future recreational consumers.

Medical patient numbers are growing quickly from less than 1,000 in early 2017, when the medical program opened, to 13,000 at year end according to public insurance data.

Other estimates put the total public and private patient population at 30,000 at year end.

For reference there are an estimated 300,000 medical patients in Canada under a medical program that has been running for over 16 years.

Germans Have Spending Power

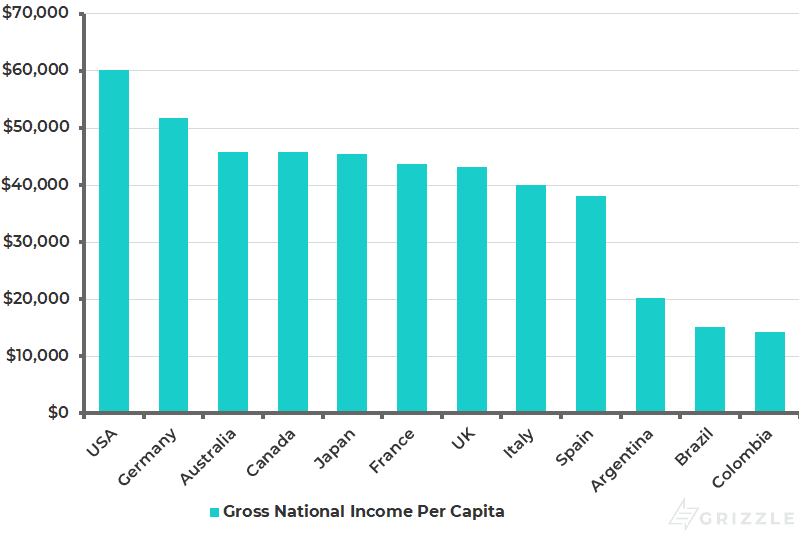

Germany is a wealthy developed country and sports a higher Gross National Income Per Capita (GNI) than Canada and all but 15 countries worldwide.

GNI is one measure of a country's income and can be used as a rough proxy for wealth.

Selling to wealthier countries means Canadian firms can charge more per gram for their products and customers can afford to pay the cost.

Medical cannabis in Germany sells for the equivalent of 35 Canadian dollars compared to 8-10 dollars per gram in Canada, a huge premium.

Gross National Income Per Person (USD)

Source: World Bank

Location, Location, Location

Germany is smack in the middle of the Eurozone and presents a perfect staging point for growers to process and distribute cannabis products to the entire region of 510 million people and beyond as regulations evolve.

Local operations let producers avoid long distance shipping and distribution costs as well as some taxes, a key factor to keep costs low when competition is fierce, as it is expected it to be.

Most Importantly, Medical Cannabis is Legal and Regulations continue to Loosen

Germany rivals Canada for the most advanced cannabis regulatory system in the world. Consumers are able to purchase medical marijuana and obtain reimbursement by three of the largest public health insurers as well as some private insurance plans.

There is already a well established regulatory framework for consumption and the government is in the process of tendering for growers to begin supplying the market so cannabis imports can eventually be phased out.

German Legal Cannabis - The Reality

Germany has huge potential on the surface, but the political landscape points to a market that will take years to develop to what investors and producers want and need it to look like.

Domestic Cultivation Will be Tiny for the Next 5 Years

Germany’s Institute for Drugs and Medical Devices (BfArM) put out a bid in April 2017 for 10 companies to grow 2,000 kg starting in 2019 and 6,600 kg by 2022.

The tender was recently cancelled due to legal challenges from cultivators and was restarted in late July, pushing first cultivation off to 2020 at the earliest.

The delay almost assures that Canadian growers will not be able to count on Germany for any meaningful capacity expansion opportunities for at least 5 years.

The government knows demand will far exceed 6,600 kg which is only enough to supply 36,000 patients.

The small size of the tender and requirement that 4 years of clinical trials be completed before talk of recreational legalization moves forward, is a clear indication that the German government plans to take a slow and measured approach to opening up the market.

Citizens Are Banned From Owning Marijuana Stocks

Regulators know that millions of citizens owning shares in global cannabis growers will only increase the political pressure on them to open the market to foreign supply.

In a very public move demonstrating the lengths government will go to keep control of the legalization timeline, Clearstream, the clearing service for all stocks traded on German exchanges, announced in June that German citizens could no longer buy any global cannabis companies.

The list of banned firms is here.

The government wants to ensure financial success does not legitimize the drug and lead to increasing patient access without supporting medical data.

Engineered Supply Shortage is Making Treatment Extremely Expensive

The lack of domestic cultivation and strict import requirements are causing an artificial supply shortage, raising the price of treatment to as high as €1,800 Euros a month for some patients.

Excessively high costs and insurers who approve only 2 out of every 3 prescriptions requests, guarantee demand will grow slowly for now.

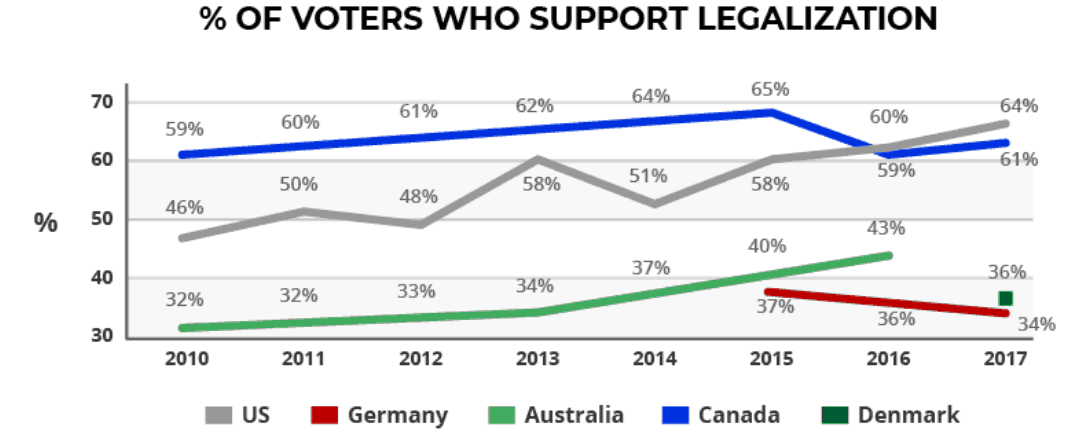

Public Opinion is Firmly Against Recreational Marijuana

Germans may support access to medical cannabis under special circumstances, but when it comes to more relaxed use of the drug, public support is far too low to push through meaningful political change.

Gallup, Ipsos, Forsa, Roy Morgan Research, Australian National University

Why is This Important for My Portfolio?

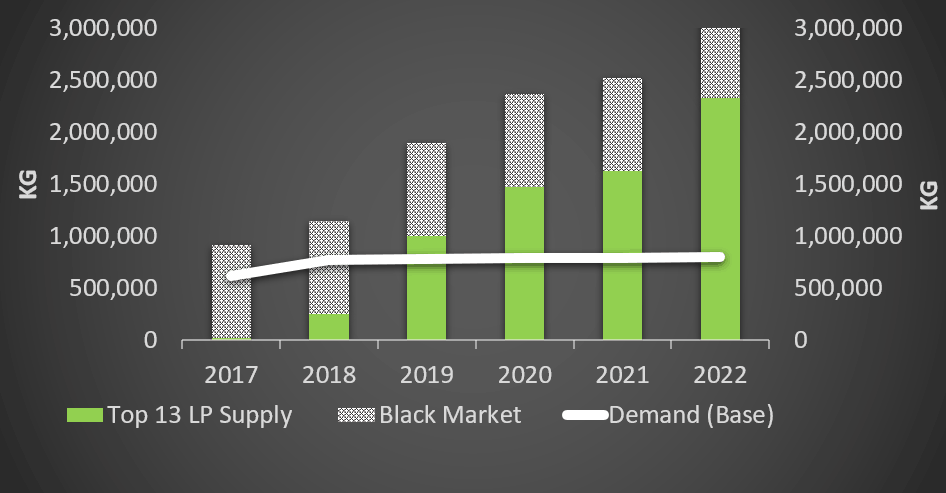

Canadian producers are on track to grow almost 3 million kilograms of marijuana annually by 2021, over two times more than Canada can ever consume.

Two million kilograms would require 20 million German's, or 23% of the population to use cannabis, compared to only 12% of the population consuming cannabis in American and Canada today.

20 million new legal users in 3 years is a highly unlikely outcome.

Cannabis Supply and Demand Outlook (Canada)

Source: StatCan, Grizzle Estimates

If licensed producers are not able to export the excess to other markets, Canada is headed for a serious supply glut.

In an oversupply scenario wholesale prices will fall 50% or more, causing cannabis companies to severely miss earnings estimates, leading to a mass selloff of stocks tied to the drug.

Though the rest of the world presents an enticing new market for Canadian supply, stock prices imply new markets are opening rapidly, when in actuality political change and public acceptance are happening gradually.

Germany will one day be a large thriving market for legal cannabis, but one day is not good enough for Canadian companies desperate to find a new market for their rapidly expanding supply and for stock investors who need explosive revenue growth to justify sky high multiples.

Read the full article