The old stereotype of the potent pot brownie made by your eclectic uncle is now sorely outdated.

Edibles are not just baked goods anymore. In our definition of edibles we include cannabis oil, pills and any other product that is ingested instead of smoked.

Cannabis edibles are one of the fastest growing segments in legal US states and are much more profitable than selling raw flower.

To help investors understand the market opportunity we will look at non-flower sales in legal U.S. states and illuminate the licensed producers in Canada who are best positioned to benefit from the growing consumer preference for smokeless products.

Edibles in America

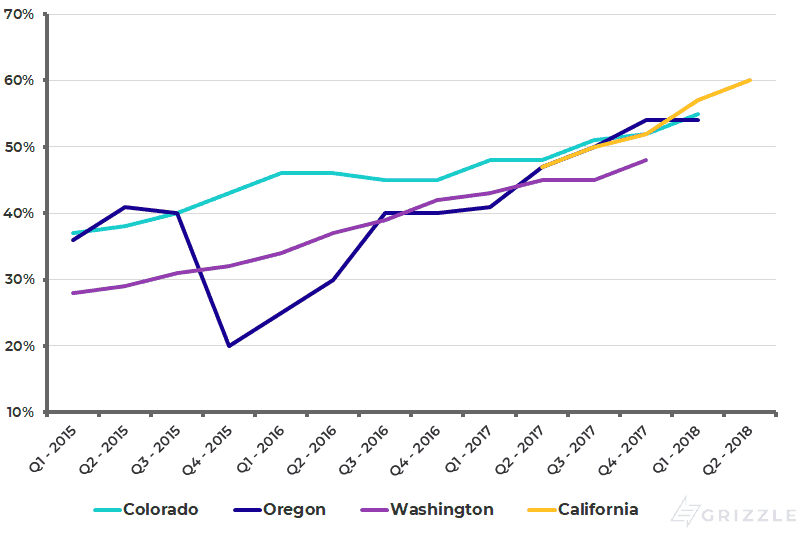

Edible sales in America are growing rapidly and in most legal states sales of raw flower make up less than 50% of sales.

Non-Flower Sales (%)

Source: BDS Analytics

The non-flower market in America is worth at least $3 billion with candies, beverages and baked goods making up about 15% of the total or $450 million.

Assuming similar market share, edibles will be a billion dollar business in Canada within two years.

In more tourist friendly states like Nevada edibles such as brownies, candies and cookies make up 45% of all sales while in larger markets like California those same products are 15% of sales but growing rapidly.

Sales of edible products like candies and baked goods are the fastest growing and most profitable segment in cannabis.

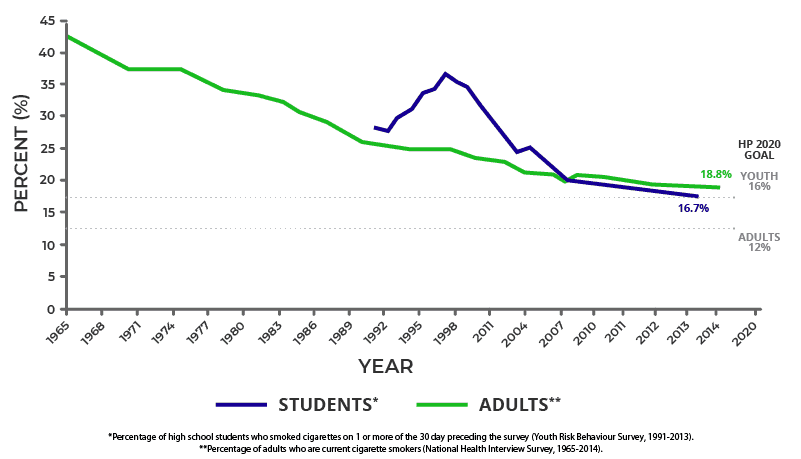

The main trend driving the growth in the edibles market is a preference for smokeless products among consumers.

Smoking rates in America are falling with the adult smoking rate down to 15.5% in 2016 from more than 40% in the 1960's.

A growing number of consumers prefer a discreet product that can be ingested without causing unwanted damage to their lungs.

Trends in Current Cigarette Smoking by high school students and adults

(United States, 1965-2014)

Source: CDC

Edibles are where the Profits are

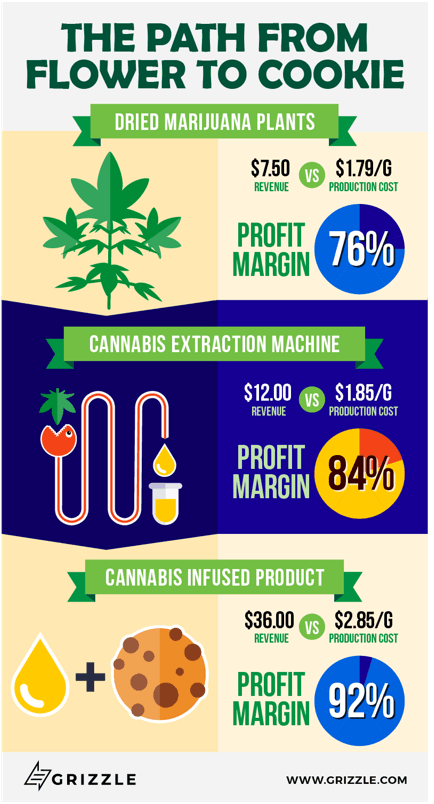

Edibles may make up a smaller percentage of sales than flower when you exclude oils, but because of their far superior profitability candy and baked goods can generate 40-60% of a dispensary's profits.

This infographic demonstrates how much better the profitability of edible oils and baked goods are compared to flower.

Who is Best Positioned to Benefit from Edibles in Canada

Licensed producers in Canada are well positioned to provide the raw ingredients needed to enter the edibles market themselves once it is legalized in 2019.

Cannabis oil will be the preferred raw ingredient for infused beverages, candies and many other edible products, so look for companies with significant oil processing equipment and capacity.

Edibles Market Top 3

Canntrust (TSE: TRST)

CannTrust already generates 60% of revenue from oil sales so is the purest way to play the growth in demand for edibles. Current oil sales capacity amounts to 2,300 kg.

Aphria (TSE: APH)

Aphria announced it's center of excellence in June, a oil processing facility that will increase oil capacity to over 220,000 kg a year by May of 2019.

Aurora Cannabis (TSE: ACB)

Through its acquisitions of Medreleaf and CanniMed Aurora will have processing capacity of at least 200,000 kg a year by early 2019.

Companies with operating and in construction oil processing facilities will be well positioned to enter the edibles market as it develops in Canada.

Once edibles become legal producers will need to decide if they want to be an oil wholesaler or go all the way down the value chain and produce the edible products themselves.

Getting into the edibles market requires a well defined sales and marketing strategy, but the profits are worth the effort.

The stock market prefers growing capacity as the preferred metric to judge one licensed producer from another, but very soon investors will realize the real money is in smokeless products.

Read the full article