Aphria announced earnings results for the 4th quarter and full year 2018 that continue to far exceed peers.

Some investors will likely be disappointed that Molson did not choose Aphria as it infused beverage partner, but we would be buyers on any stock market weakness as Aphria is demonstrating it will thrive with or without a large beverage partner.

The company continues to generate positive EBITDA, which is a similar metric to cashflow, with an 18% EBITDA margin in the quarter in their core Canada business.

The newly acquired international businesses are dragging down results as they build out capacity, but the core cultivation business in Canada is the most profitable in the industry.

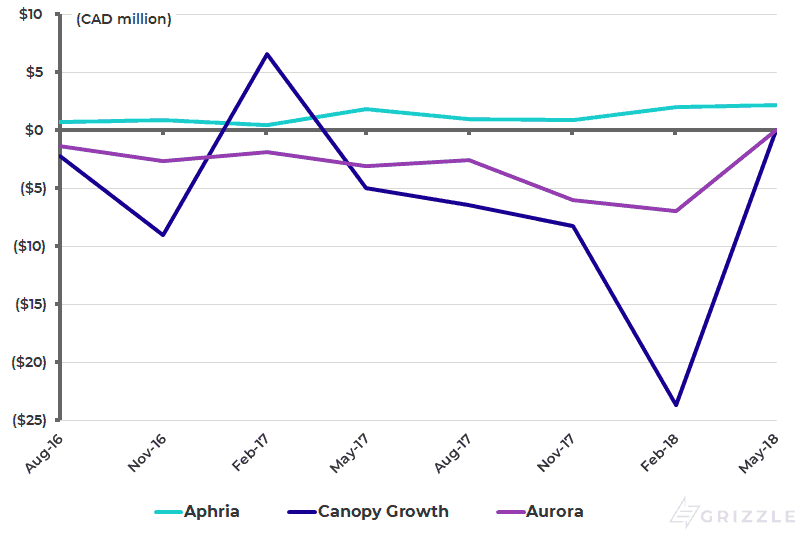

Aphria is still the only large producer generating positive EBITDA. If management is able to generate cashflow while rapidly scaling up capacity, building out a workforce and adding international capabilities, the odds look good they can remain highly profitable once the recreational market opens in October.

EBITDA of Aphria, Canopy and Aurora in the last 8 Quarters

Source: SEDAR

Operational Review

EBITDA in the Canadian business was $2.2 million for the quarter and $8.4 million for the year.

This may sound impressive, but with 230,000 kg of capacity up and running in early 2019, we think Aphria could potentially generate $180 million of EBITDA in 2019.

The newly acquired international segment lost $2.2 million in the quarter and will be a drag on results until capacity and sales can be established.

With international losses included, the EBITDA loss of $500,000 is only 5% of revenue compared to Aurora Cannabis and Canopy Growth who are losing 43% and 100% of revenue every quarter respectively.

Growing Costs Still Best in Class

The cost to cultivate, package and sell marijuana is so important because this is an industry where the raw material is incredibly easy to grow, meaning supply is abundant.

We think excess supply could appear in the second half of 2019 and push down the retail price for all types of marijuana product categories.

The company with the lowest cost of production will have the most flexibility to lower its price to consumers to maintain sales while still generating cash.

Aphria had all-in production costs of $1.60 per gram in the latest quarter, the lowest in the industry.

They are well positioned to be one of the growers left standing if an oversupply pressures the industry in the coming years.

In the chart below looking at growing costs we include estimated costs for shipping to compare all companies on an equal footing as some companies exclude shipping from their all in cost of production while others include it.

All-in Production Costs Per Gram for the Top 8 Licensed Producers

Source: Grizzle Estimates, SEDAR

Molson Chooses Hydropothecary, Aphria Will Endure

The market was disappointed that Molson did not announce a deal with Aphria and many investors rotated from Aphria into Hydropothecary (Ticker: HEXO) throughout the day.

Molson's decision likely came down to price at the end of the day as many of the large licensed producers have similar capabilities at this stage in the market's development.

HEXO is building less than half the capacity of Aphria and has double the all-in production cost, so capabilities were not the sole determinant of this deal.

We are missing enough deal information to draw an accurate conclusion, but given that Molson was granted warrants by HEXO and no cash investment was reported to establish the new entity, we are not sure what immediate value Molson contributed.

A deal structure made solely of warrants is a far cry from Constellation Brand's direct cash investment in Canopy Growth and does not demonstrate the same level of confidence in HEXO's strategy compared to Canopy Growth.

Bottom Line

Even though Aphria was passed over, Molson is not the only beverage giant looking to enter the cannabis market.

Aphria will continue to build out its capabilities and will likely be an investment target for another beverage giant in the months to come.

Low costs and good execution don't go unnoticed for long.

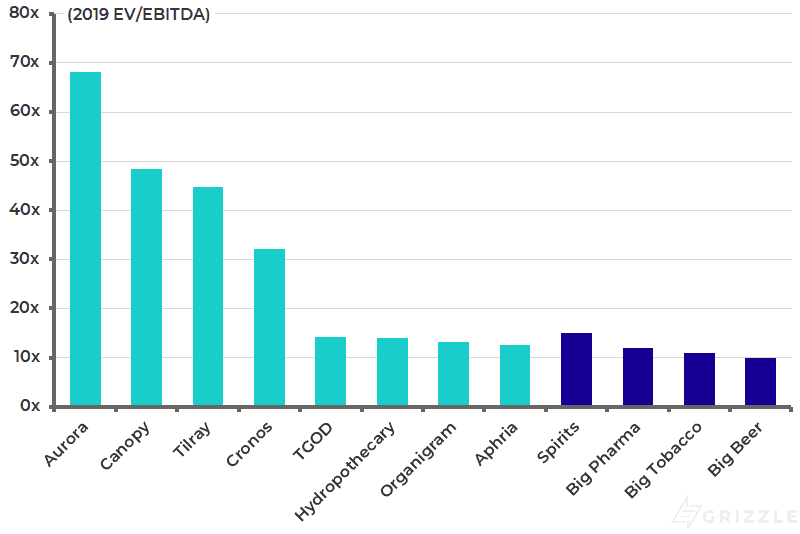

Aphria Trading at a Big Discount to Aurora and Canopy

The fact that you can buy the stock of the best operator in the Cannabis space for a huge discount, makes it abundantly clear that stock prices are currently driven off of hype and management salesmanship.

Aphria has not been as promotional as peers and hasn't signed dozens of wildly expensive but splashy mergers.

This has actually hurt their perception in a market that is driven by hype.

When the recreational market opens and companies are judged on results not talk, we think Aphria's stock will significantly outperform peers.

If you are looking for one stock to own in this industry we think Aphria is a must buy.

If you are cautious about an oversupply and falling prices in 2019, a purchase of Aphria, while shorting a basket of Aurora Cannabis and Canopy Growth should provide excellent performance even as the market digests lower retail prices.

Trading Multiple of EBITDA

Source: Grizzle Estimates, SEDAR, Bloomberg

In an industry full of promotors and management teams making promises they can't possibly meet, Aphria stands out.

They may not have the largest funded capacity, or a web of companies they purchased that operate in every possible business marijuana can touch, but they have a best in class cost structure and a management team that talks straight with investors.

Three months from now stock prices will no longer go up just because management teams are promising global domination.

The companies that execute on their promises, keep costs down and quality high will be the ones who make investor's money and we think Aphria will be in that group.

This quote from management demonstrates why they are best in class.

Read the full article