“Oil forecast to hit peak demand by 2036”. Such was the headline in a newspaper article recently (see Financial Times article: “Oil forecast to hit peak demand by 2036” by David Sheppard, 16 July 2018).

The article refers to a Wood Mackenzie prediction that global oil demand will peak by 2036 as a result of a ”tectonic” shift in the transport sector towards electric cars and autonomous vehicles.

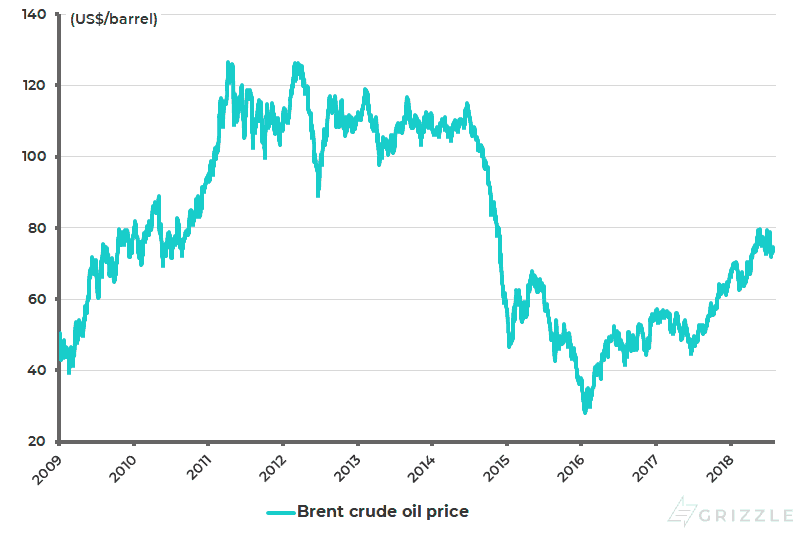

Brent crude oil price

Source: Bloomberg

Maybe the above is true. Still, the view here remains that the oil price can go much higher in the current cycle despite the correction in prices seen in recent weeks (see previous chart).

The key reasons why refers to the points already mentioned here.

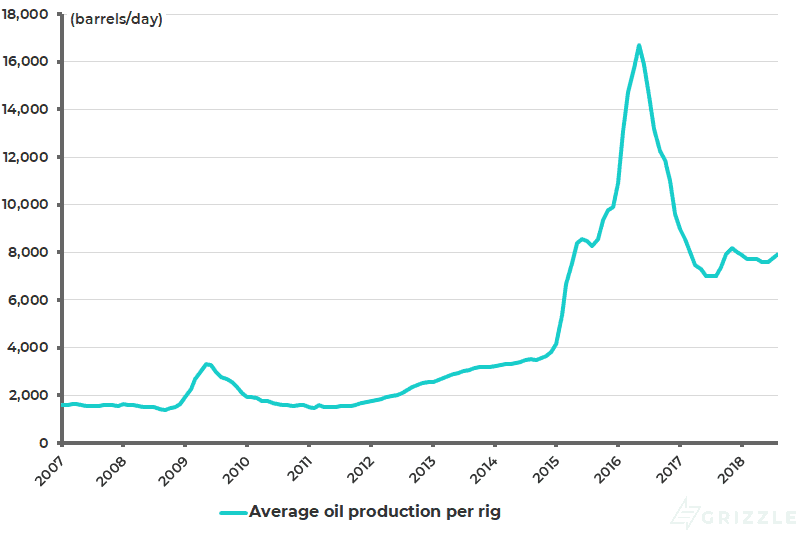

First, shale production in the US is not increasing as much as expected. Average oil production per rig from seven major US shale regions peaked at 16,703 barrels/day in May 2016 and has since declined to 7,614 barrels/day in June, according to the US Energy Information Administration (see following chart).

US average oil production per rig from 7 major shale regions

Source: CLSA, US Energy Information Administration (EIA) – Drilling Productivity Report

Investment in New Supply remains low despite strong demand

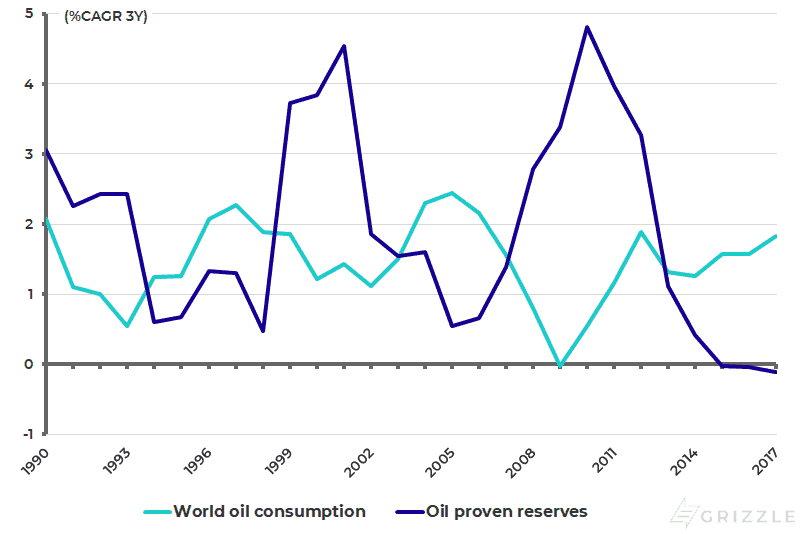

Second, and more importantly, there has been chronic under investment in new supply while energy demand continues to remain strong. The result of this collapse in investment is a deceleration in the oil industry’s reserves and so-called reserve replacement ratio.

Global proven oil reserves declined by an annualized 0.1% in the three years to 2017, down from an annualized 4.8% growth in the three years to 2010 (see following chart). By contrast, global oil consumption rose by an annualized 1.8% in the three years to 2017.

Growth in global oil consumption and proven reserves

Source: BP – Statistical Review of World Energy

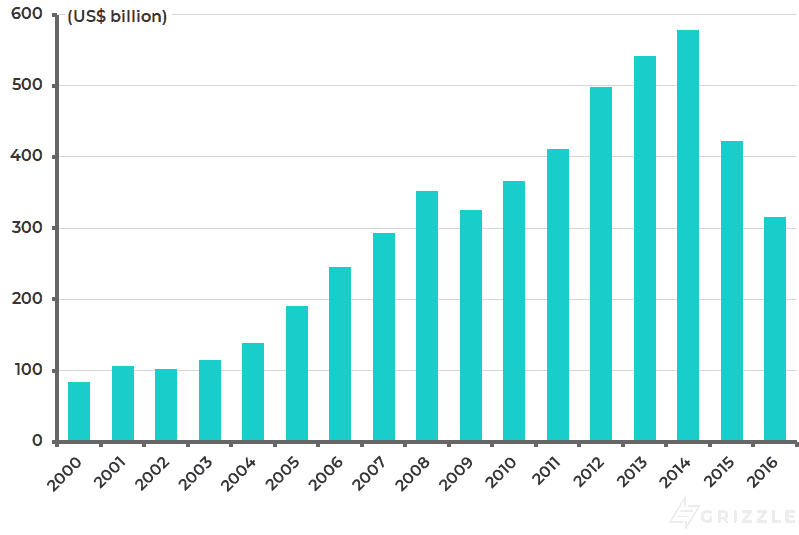

Meanwhile, the reserve replacement ratio, measured as total oil and gas discoveries relative to production, declined to 11% in 2017, compared with over 50% in 2012, according to energy research firm Rystad Energy. As for investment, total world upstream oil capital investment fell 45% from US$578bn in 2014 to US$316bn in 2016, according to the US Energy Information Administration (see following chart).

World upstream oil capital investment

Source: US Energy Information Administration (EIA)

Peak Oil and an Electrified Future Or Back to Diesel?

Yet, the natural inclination to increase supply in response to rising prices is still being constrained by the continuing belief in the demise of the fossil fuel industry, as reflected in the above Wood Mackenzie forecast. Also, institutional investors’ have continued to pressure major oil companies in recent years to increase their share buybacks, pressures they have succumbed to, rather than spend money on exploration.

Meanwhile, amidst the now overwhelming consensus on the bright future for electric vehicles, autonomous cars and the like, it was interesting to read contrasting comments on the possible return of current out-of-fashion diesel in an interview in the Indian press earlier this month with a senior executive from Dow Chemical.

A.N. Sreeram, chief technology officer at Dow, termed lithium-ion batteries as a “fad of the decade” and said electric cars will become unsustainable as Bolivia’s lithium mining dries and disposal of batteries becomes a challenge. He also argued that diesel will return as a preferred fuel in the years to come, adding that global warming is a highly complex and an under-studied problem, despite the earth having gone through several cycles of ice melts and refreezing.

This writer does not pretend to be an energy expert but is intrigued by the above comments. Indeed, the overwhelming hype concerning the end of fossil fuel, and related hype concerning mostly taxpayer subsidised alternative energy, reminds one the so-called “Club of Rome” hype in the 1970s when the green lobby was predicting that the world would run out of food.

US Foreign Policy Aiming to Cut out Iranian Supply

Away from such “big picture” issues, there is also a nearer term factor that could serve as a catalyst for higher oil prices. That is the American demand, made on 26 June, that the world should stop importing Iranian oil by early November.

This is a big deal, if really enforced, since Iran accounts for about 5% of global oil supply and it is far from clear that this supply can be easily replaced. True, Donald Trump has been pressing Saudi Arabia to increase production, and it has responded in part.

The White House stated at the end of June that Saudi King Salman bin Abdulaziz Al Saud had affirmed that “the Kingdom maintains a 2m barrel per day spare capacity, which it will prudently use if and when necessary to ensure market balance and stability”. But the risk is that if Saudi increases production more, it will further reduce spare capacity, creating the potential for an even bigger oil price spike should there be other supply disruptions because the industry would be running out of spare capacity.

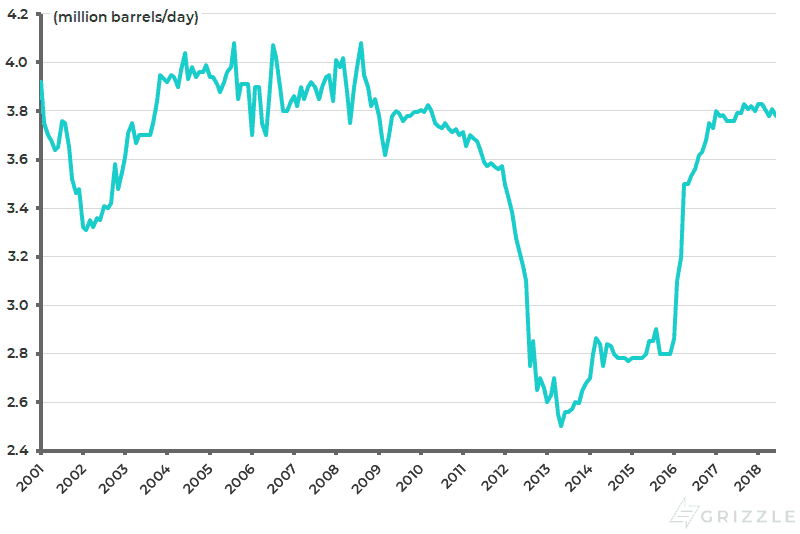

Iran crude oil production

Source: Bloomberg

The US has a Powerful Tool to Influence the World against Iranian Oil

For such reasons, and with the US mid-term elections scheduled for November, it is quite possible that America backs off its aggressive stance of seeking to block everyone from importing oil from Iran. In this respect, China buys 8% of its oil from Iran and India 10%.

That is to assume that such countries comply with the American request. This would seem more likely in the case of India than China. That is not even to mention on what legal basis the US is making such demands given that it exited the Iranian nuclear agreement unilaterally in May.

The answer is, of course, that those not compliant face the threat of being locked out of the US dollar international payments system. This is an extremely effective form of leverage at present, though its use as a form of leverage also contains the seeds of its own destruction in terms of the long-term viability of the US dollar paper standard.

Saudi Oil Supply Nearing its All Time High

Still, this is a long-term view. For now, the key points are that Iran has increased its exports to 2.7 million barrels/day to generate as much revenue as possible before the sanctions hit while America wants to reduce this by at least 2 million barrels/day by November.

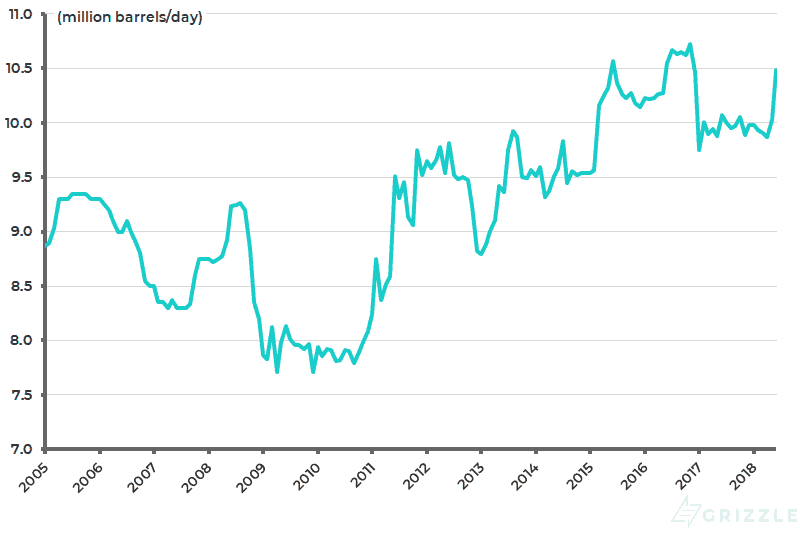

Meanwhile, Saudi has increased its production by about 500,000 barrels/day, according to OPEC (see following chart), but Donald Trump seemingly wants it to be at least 2 million. Still, Saudi has already increased production to 10.5 million a day, accordingly to OPEC.

It is far from clear such a level of production is sustainable, even if it was advisable. The highest annual average production recorded by Saudi was 10.5 million barrels/day in 2016.

Saudi Arabia crude oil production

Source: OPEC, Bloomberg

Can Trump handle the Domestic Impacts of Higher Oil Prices?

All of the above creates the risk of a boomerang effect on the Donald since a further sharp spike in the oil price would hit the disposable income of Joe Sixpack in America which is the Donald’s main support base. While ultimately proving deflationary for the American economy, it would in the short term increase inflationary angst in markets creating a dilemma for the Fed.

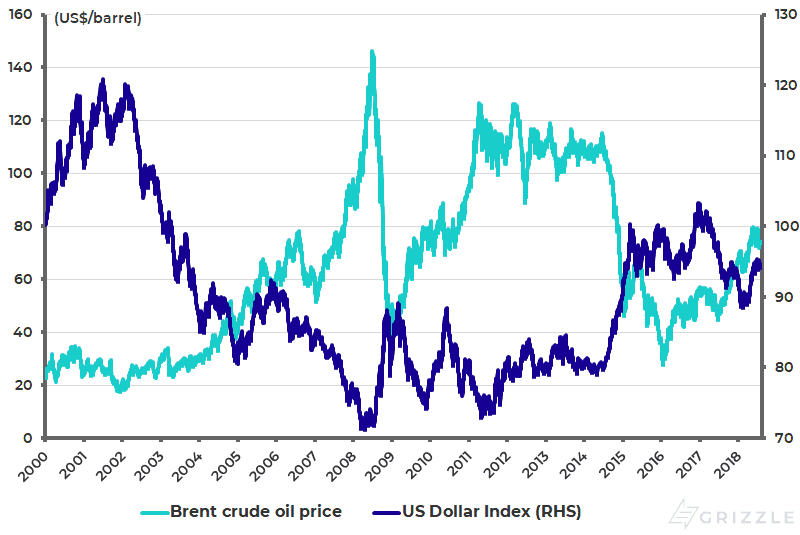

The net conclusion from all of the above is that oil has again become a critical factor in world markets and world politics. While a further spike in oil prices to the US$120-150 level would ultimately contain the seeds of its own destruction by destroying demand, it would do a lot of damage in the short to medium term; though the good news for investors in emerging markets is that a much higher oil price is unlikely to co-exist with a much stronger US dollar (see following chart).

Brent crude oil price and US Dollar Index

Source: Bloomberg

Read the full article