Volatility Horror Show

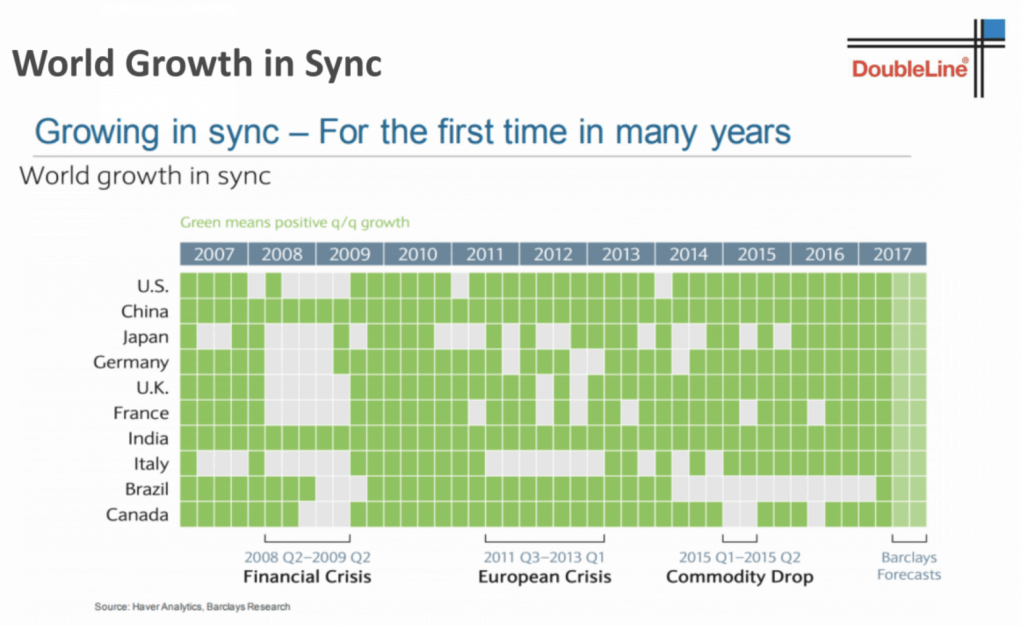

As we entered 2018 the world was absolutely rainbows. All the fancy Wall Street market pundits were gushing about how wonderful and great it was to have 'synchronized global economic growth'. The slide below from DoubleLine (Jeff Gundlach's fund management firm) summarizes the storyline rather nicely. Be it the Financial Crisis, the European Crisis or the Commodity Drop there was always something getting in the way of a truly fucking good time! (Coke without the fentanyl kind of good time). But finally, as we enter 2018 we've got every major economy across the board clocking positive GDP growth numbers. The bliss.

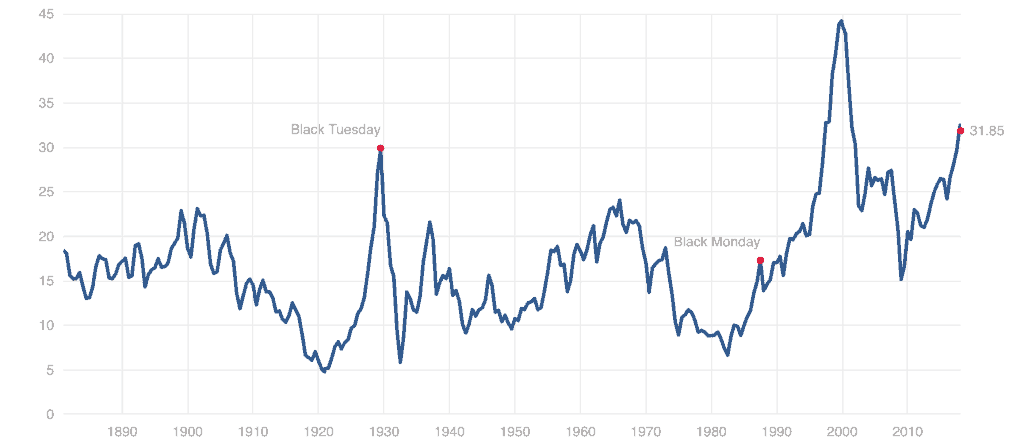

Never mind the inconvenience of extreme valuations, the S&P 500 Shiller PE (the cyclically adjusted Price to Earnings Ratio) at 31.9x is the 2nd highest on record behind only the dotcom bubble. Or the fact that this is the 2nd longest bull market on record.

Shiller Price to Earnings Ratio (Source: multpl.com)

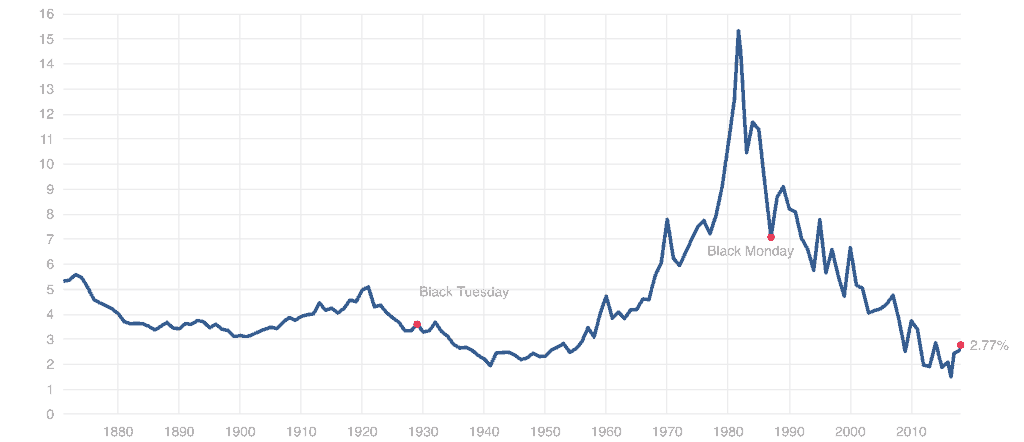

The economy was simply that good. Nothing would or could derail the Goldilocks perfection. However, a party this bloody good needs to have a little inflation, don't it? So bond yields started to climb from embarrassingly low historic levels.....

10-year U.S. Government Bond Yield

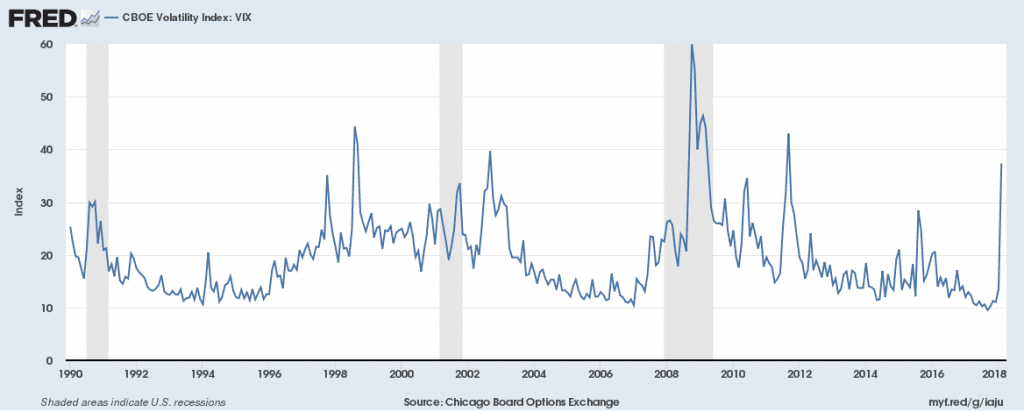

And pow, volatility is back muthafuckers! The VIX Index (market gauge of risk) experienced the biggest percentage spike in history (rising above 40%) on Monday, and the DOW plunged -4.6%. The absolute low levels of volatility during this bull market had lulled Wall Street en masse to move significantly higher up the risk curve to seek additional returns (because safe gives you relatively nothing — 10-year government bonds yielding sub-3%).

CBOE Volatility Index (VIX)

In his inaugural edition of Macro Battleship, Chris Wood highlighted this very real and present danger for global stock markets in 2018 — quantitative tightening in a world of meddling economic growth. It's vital reading for choppy volatile markets.

Millennial Bets at Risk

It's been a rough go for millennial money 'trends'. Grizzle's conviction remains with crypto (Bitcoin and Ethereum to be exact), while the bubbles of robo-adivsory and Canadian marijuana stocks are beginning to unravel.

Robo-advisors not being so very Robo

We view the propensity of millennials to stuff what little discretionary income they have into online 'Robo-adviors' as structurally flawed for two reasons:

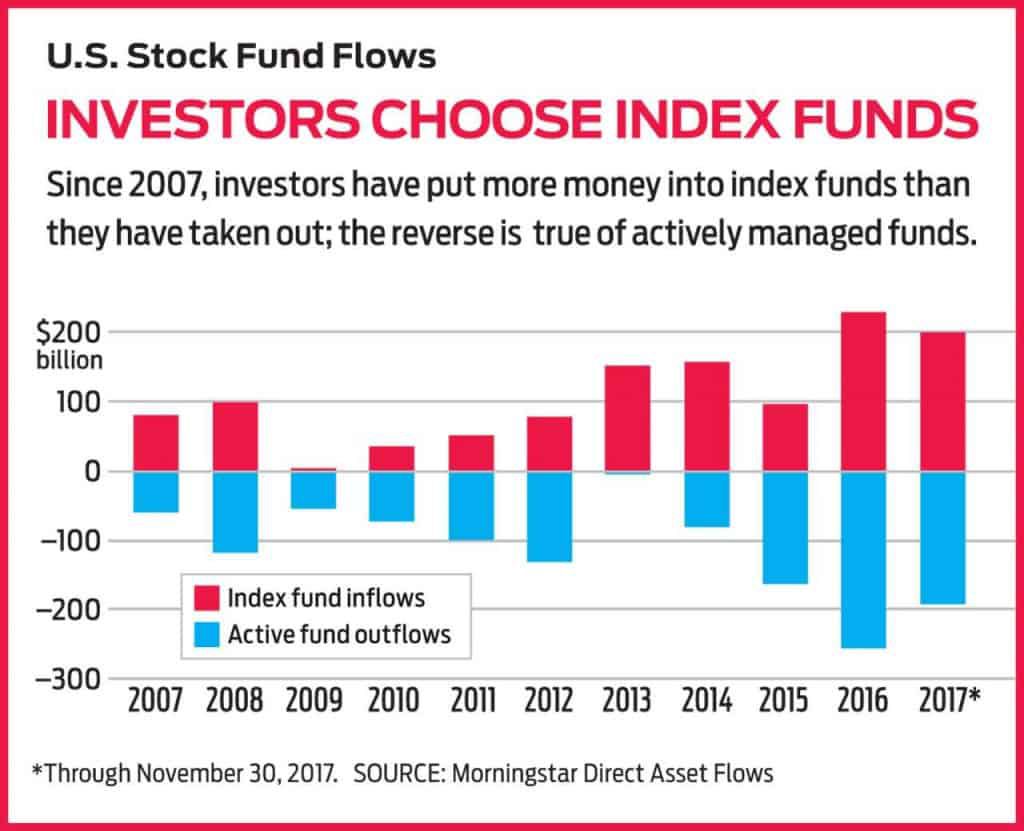

1. Indexing isn't a fail-safe path to financial freedom.

While we completely understand the face value of indexing (saving fees) versus an active management industry that in a best-case scenario is closet indexing or worst case are just simply bad investors, we believe there are serious risks related to the blind faith assumption that index investing always wins.

The more money that chases index product (i.e. everyone owns the same proportion of the same companies), the higher the correlation of the overall market, making these indices and the companies within them particularly vulnerable to spikes in volatility as everyone sells out of the exact same names at the exact same time.

The companies held within these indices are also problematic. For a generation that values artisan food and bespoke tailoring, investing their money blindly into god awful boomer brands they would never buy or consume themselves (i.e. Dr. Pepper).

2. Robo-advisors are inherently better at managing your diversified index ETF investments than you are.

The market route has exposed the fallacy that the high computer automation / low human touch approach for wealth management is the way of the future, ZeroHedge exposes the very real risks of this approach:

If your fundamental belief is that low cost index is the way to go, then take that extra step and just do it yourself. It's not rocket science, and when the pressure is on (Dow sell-off) and the 'Robo' simply doesn't make it to work, what the fuck is the point really?

Up in Smoke - The Overvalued Haze of Marijuana Stocks

Grizzle published a deep dive macro report on the highly inflated Canadian marijuana sector, the sell-off has begun, however the carnage shall continue. Key points of the report:

Legalization = lower prices. Period.

The black market is the elephant in the room — Canada already is fully supplied!

Extreme valuations inline with nonsensical commodity bubbles (i.e. rare earths).

It's a toxic combination of euphoric investors and the corporate executive D-league, it will not end well.

Crypto - HODL or Die Trying

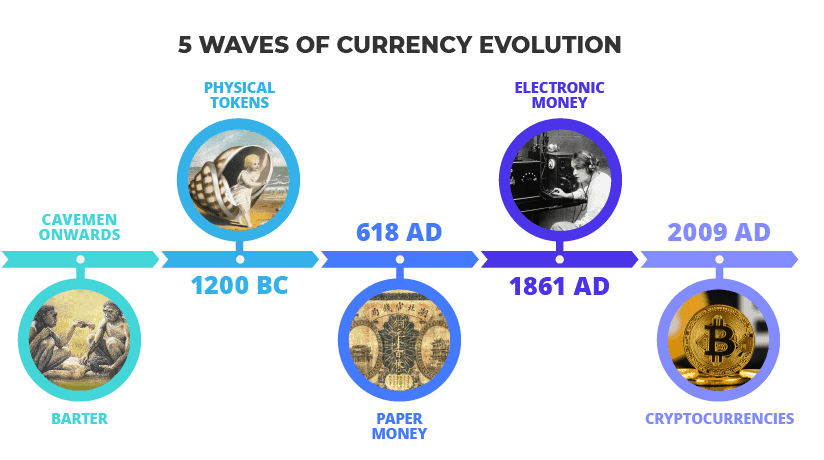

We are resolute in our belief that cryptocurrencies mark the fifth distinct phase in the evolution of money/value exchange. That being said Bitcoin failed a key 'store of wealth test', exhibiting a degree of uncorrelated attributes (i.e. if the broad market pukes, Bitcoin must stay flat at the very least). Our very thorough and readable Bitcoin review lays out all the challenges and opportunities that lay ahead. We are HODLers (hold for for life).

Read the full article