Global Risk-Off Everything - Crypto isn't Immune

Disheartening would be an understatement. A cleansing was certainly needed for global risk asset classes (equities, high yield debt). Chris Wood rightly nailed the trigger — rising government bond yields as the clear and present danger. Much of crypto coinland was in need of a clean-up too — too many bad actors and dodgy ICOs. Risk-taking across the board needed to be reigned in, however, what we got last week was everything on the shelf getting taken to woodshed — absolute carnage.

Tether and the Mysteries of Fractional Reserve Banking

Tether and the gang over at Bitfinex are spooking the market again. The U.S. Commodity Futures Trading Commission (CFTC) issued subpoenas to both companies on December 6 (publicly announced February 3). It's suspected the CFTC is investigating whether Tether (USDT) is truly genuinely backed 1 to 1 by U.S. Dollars (as it's supposed to be).

Let's review the purpose of Tether coins. After purchasing Bitcoin (or any other crypto for that matter), if an investor wants to sell and sit on the sidelines Tether is the most efficient way to do that as it theoretically should always be equal 1:1 with USD (fully backed), otherwise the investor is hit with the logistical burdens and additional transaction fees while trying to come back into their local currency.

The accusation is that there is less that 1 USD backing every 1 USDT, i.e. Bitfinex has been creating Tether out of thin air - problematic to say the least. This is fractional reserve banking for crypto, an increase in money supply, as long as all the Tether depositors don't look to convert back to USD at once the gig keeps going. Or, more simplistically, it can be viewed as a Ponzi scheme.

The genuine worry here is that this faux supply of Tether has been propping up the Bitcoin as well as other crypto markets. There's $2 billion USDT in circulation currently, the question is how much fake USDT was created in the past and funnelled into Bitcoin. Very difficult to answer with accuracy (forensic crypto accounting is the only way to truly know).

Specifically for Bitcoin our best guess is that it's a problem in the factor of sub-$10 billion (6% of Bitcoin's market cap). This is manageable for the market. We have deep reservations about the claim that USDT is responsible for 49% of BTC value increase in the last year. We believe much of it can be chalked up to classic market speculation.

HODL or Die - Flushing Out the Weak Trading Hands

For Bitcoin to survive this nuclear winter it must exhibit some uncorrelated attributes. If global equity markets are puking, Bitcoin should be rallying or at the very least holding steady. This is the 'value' bestowed on an uncorrelated store of value asset classes — the attribute that gives gold value. Bitcoin must, and frankly has to, aspire to this. Flushing out the day traders in Bitcoin is a must, HODLers must make up the majority of asset holders.

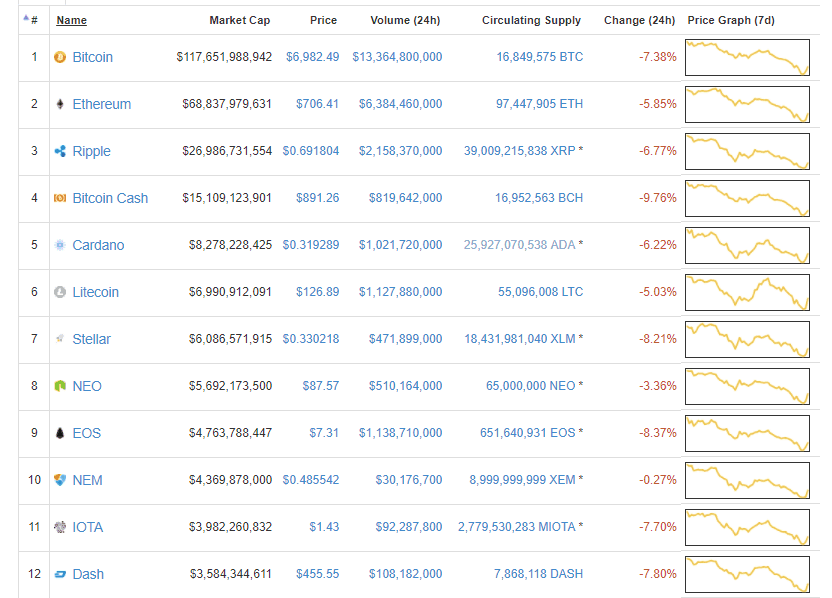

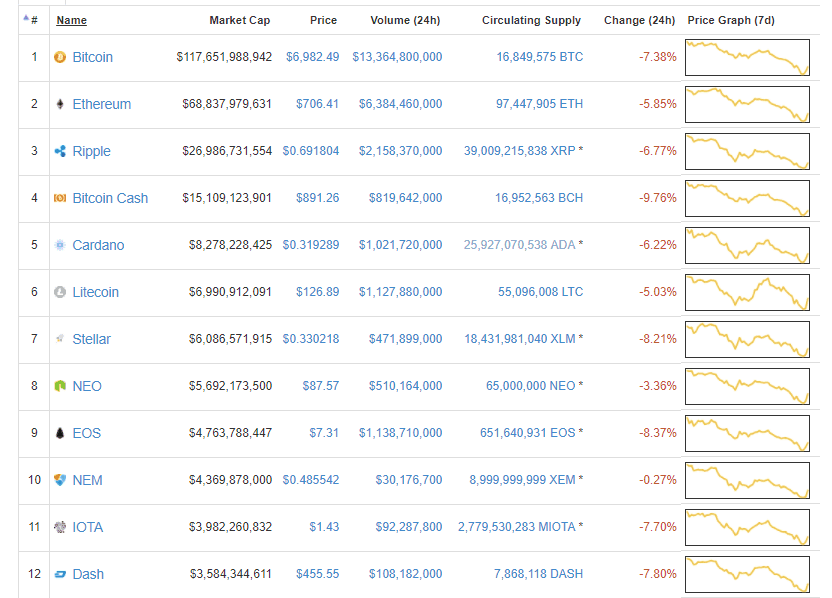

Crypto prices at February 6, 2018 (Source: Coinmarketcap)

Read the full article

Disheartening would be an understatement. A cleansing was certainly needed for global risk asset classes (equities, high yield debt). Chris Wood rightly nailed the trigger — rising government bond yields as the clear and present danger. Much of crypto coinland was in need of a clean-up too — too many bad actors and dodgy ICOs. Risk-taking across the board needed to be reigned in, however, what we got last week was everything on the shelf getting taken to woodshed — absolute carnage.

Tether and the Mysteries of Fractional Reserve Banking

Tether and the gang over at Bitfinex are spooking the market again. The U.S. Commodity Futures Trading Commission (CFTC) issued subpoenas to both companies on December 6 (publicly announced February 3). It's suspected the CFTC is investigating whether Tether (USDT) is truly genuinely backed 1 to 1 by U.S. Dollars (as it's supposed to be).

Let's review the purpose of Tether coins. After purchasing Bitcoin (or any other crypto for that matter), if an investor wants to sell and sit on the sidelines Tether is the most efficient way to do that as it theoretically should always be equal 1:1 with USD (fully backed), otherwise the investor is hit with the logistical burdens and additional transaction fees while trying to come back into their local currency.

The accusation is that there is less that 1 USD backing every 1 USDT, i.e. Bitfinex has been creating Tether out of thin air - problematic to say the least. This is fractional reserve banking for crypto, an increase in money supply, as long as all the Tether depositors don't look to convert back to USD at once the gig keeps going. Or, more simplistically, it can be viewed as a Ponzi scheme.

The genuine worry here is that this faux supply of Tether has been propping up the Bitcoin as well as other crypto markets. There's $2 billion USDT in circulation currently, the question is how much fake USDT was created in the past and funnelled into Bitcoin. Very difficult to answer with accuracy (forensic crypto accounting is the only way to truly know).

Specifically for Bitcoin our best guess is that it's a problem in the factor of sub-$10 billion (6% of Bitcoin's market cap). This is manageable for the market. We have deep reservations about the claim that USDT is responsible for 49% of BTC value increase in the last year. We believe much of it can be chalked up to classic market speculation.

HODL or Die - Flushing Out the Weak Trading Hands

For Bitcoin to survive this nuclear winter it must exhibit some uncorrelated attributes. If global equity markets are puking, Bitcoin should be rallying or at the very least holding steady. This is the 'value' bestowed on an uncorrelated store of value asset classes — the attribute that gives gold value. Bitcoin must, and frankly has to, aspire to this. Flushing out the day traders in Bitcoin is a must, HODLers must make up the majority of asset holders.

Crypto prices at February 6, 2018 (Source: Coinmarketcap)

Read the full article