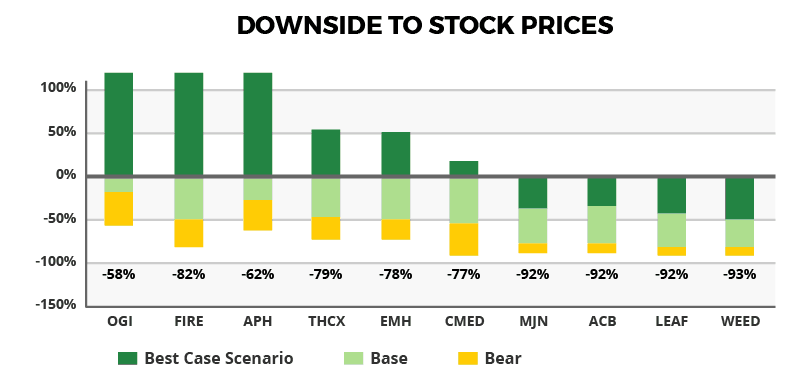

DOWNSIDE OF 65-90% FOR CANADIAN LICENSED PRODUCERS

Grizzle has produced the first truly balanced deep dive analysis of the Canadian marijuana sector. We lay bare all the inconvenient truths of this highly overvalued sector.

Euphoric retail and institutional investors have stratospherically bid up the sector, diving head first into rich equity offerings that will in aggregate allow licensed producers (LPs) to grow 2x the peak amount of marijuana this country will ever need.

We confront three inconvenient truths head on:

There is nothing special or unique about the Canadian legalization experience. It will most certainly mimic the outcome of legalized jurisdictions in the U.S. Colorado and Washington are the text book case studies with prices falling 56% and 70% respectively, four years after legalization. Analysts are factoring in a gentle 10% decline by 2021 for the Canadian market, a deeply misplaced assumption.

Historically retail marijuana prices peak 1-6 months after legalization, and commodity equities typically discount falling prices 6 months in advance, leaving the marijuana equities vulnerable to massive valuation corrections today.

The marijuana market is mature with black-market supply already exceeding demand (Canada exported 20% of marijuana production in 2017). Legal supply will have to successfully compete on price to take away market share.

Stock prices are implying the impossible: that both stable pricing and exploding volumes can occur at the same time. You can’t have both in a mature commodity market.

Marijuana stocks are trading on 2019-2020 EV/EBITDA multiples of 48x and 18x respectively, in the 98th percentile of multiples across all stocks in North America – implying extreme levels of overvaluation.

The analyst community argues big tobacco, wine and spirits are the real proxies for the marijuana market, but at multiples of 11.5x and 15.0x EV/EBITDA respectively, they provide no valuation support at these levels.

In this report we argue that an industry like marijuana with little pricing power and minimal barriers to entry should trade more in line with commodity producers at 5-6x EV/EBITDA, representing base case downside to stocks of up to 65%.

Download the full 'Up in Smoke' report here>>

Read the full article